Policyholders who exercise regularly and demonstrate a healthy lifestyle should be able to save on their medical insurance premium costs.

That was the chief finding of a Reinsurance Group of America (RGA) study1 that taps into the power of lifestyle data to help health insurers better assess risk, improve underwriting and develop propositions that incentivize healthy lifestyles.

Lifestyle factors have long been known to have a significant impact on health. Still, more research needs to be performed to correlate these factors with medical expenses as opposed to mortality, where there is a richer body of research. To close this gap, RGA set out to quantify the relationship between medical expenses and lifestyle factors that wearable devices can measure, such as physical activity, sleep and heart rate.2

RGA research draws from widely recognized databases, such as the U.S. National Health and Nutrition Examination Survey (NHANES) Results show that lifestyle factors such as physical activity, sleep and pulse rate can be tied to clear impacts on medical expenses as proxied by health care utilization measures such as hospitalization rates and mental health care visits.

Physical Activity

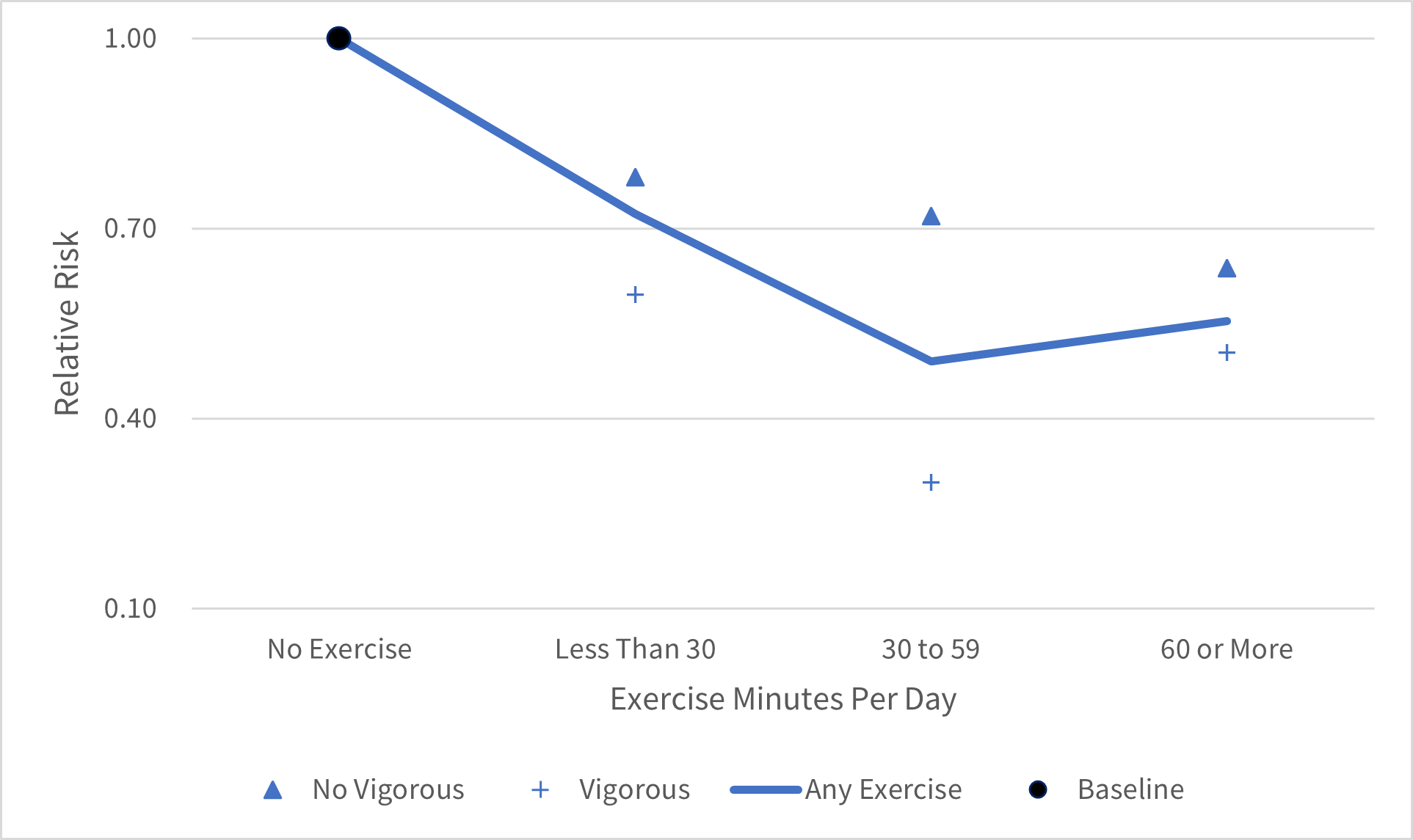

While literature has firmly established linkages between physical activity and mortality,3 RGA’s analysis ties physical activity, defined in steps or minutes of exercise per day, to medical expenses. RGA’s method compares the experience, in terms of incidence of hospitalizations and mental health visits, among different categories of physical activity (no exercise, less than 30 minutes per day and so on) and presents the results using relative risks (RR) versus the chosen baseline category. (The same methodology applies to sleep and pulse rate examined later in this article.)

Findings reveal physical activity has a visible positive effect on medical claims experience, with experience in hospitalizations and mental health visits generally improving with exercise duration. However, this improvement in experience is observed up to a certain level of physical activity (60 minutes per day), beyond which the benefits are diminished, as shown in Figure 1. This can be explained by a potential adverse impact of excessive exercise on the body.

Figure 1: Exercise Minutes per Day and Relative Risk of Medical Utilization

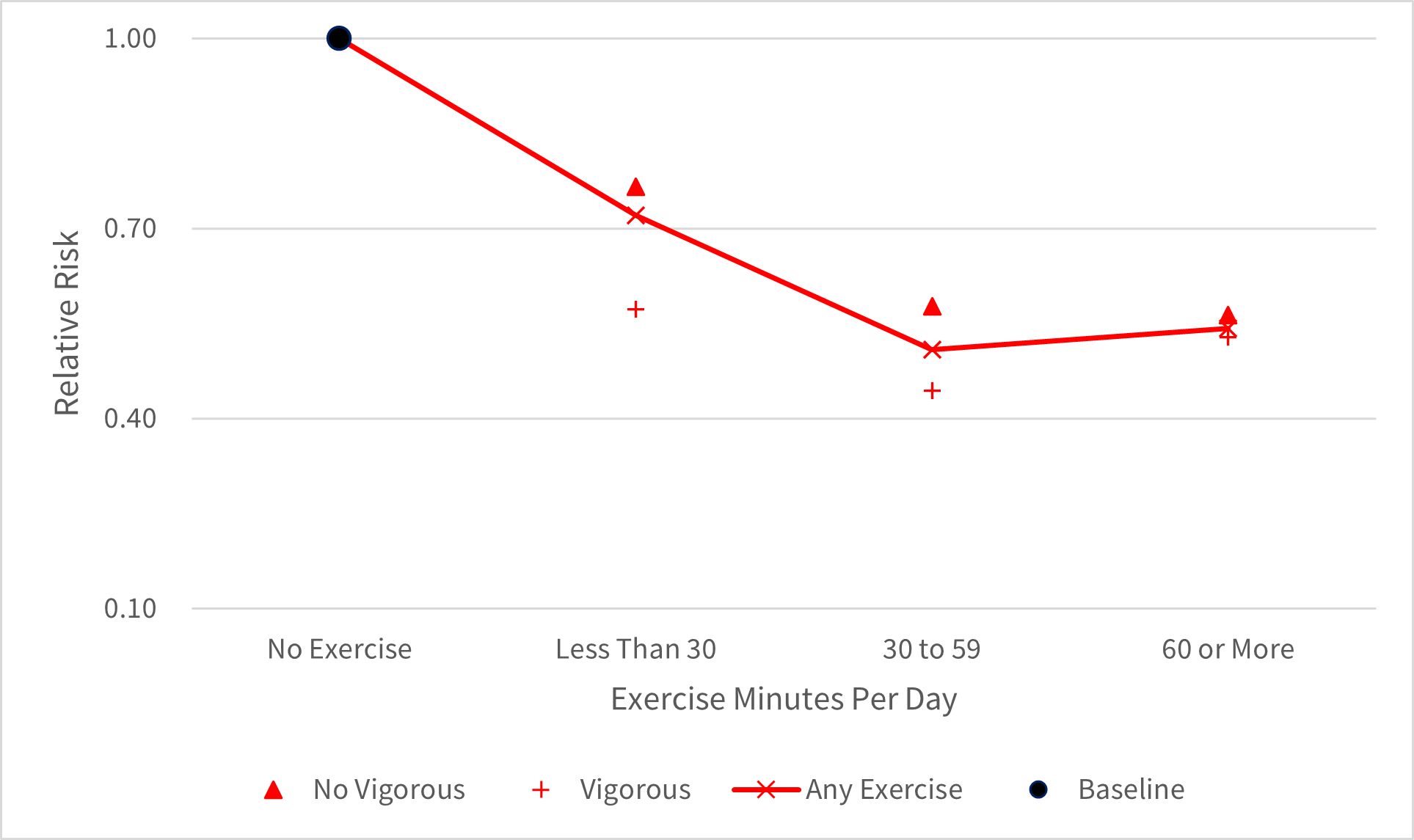

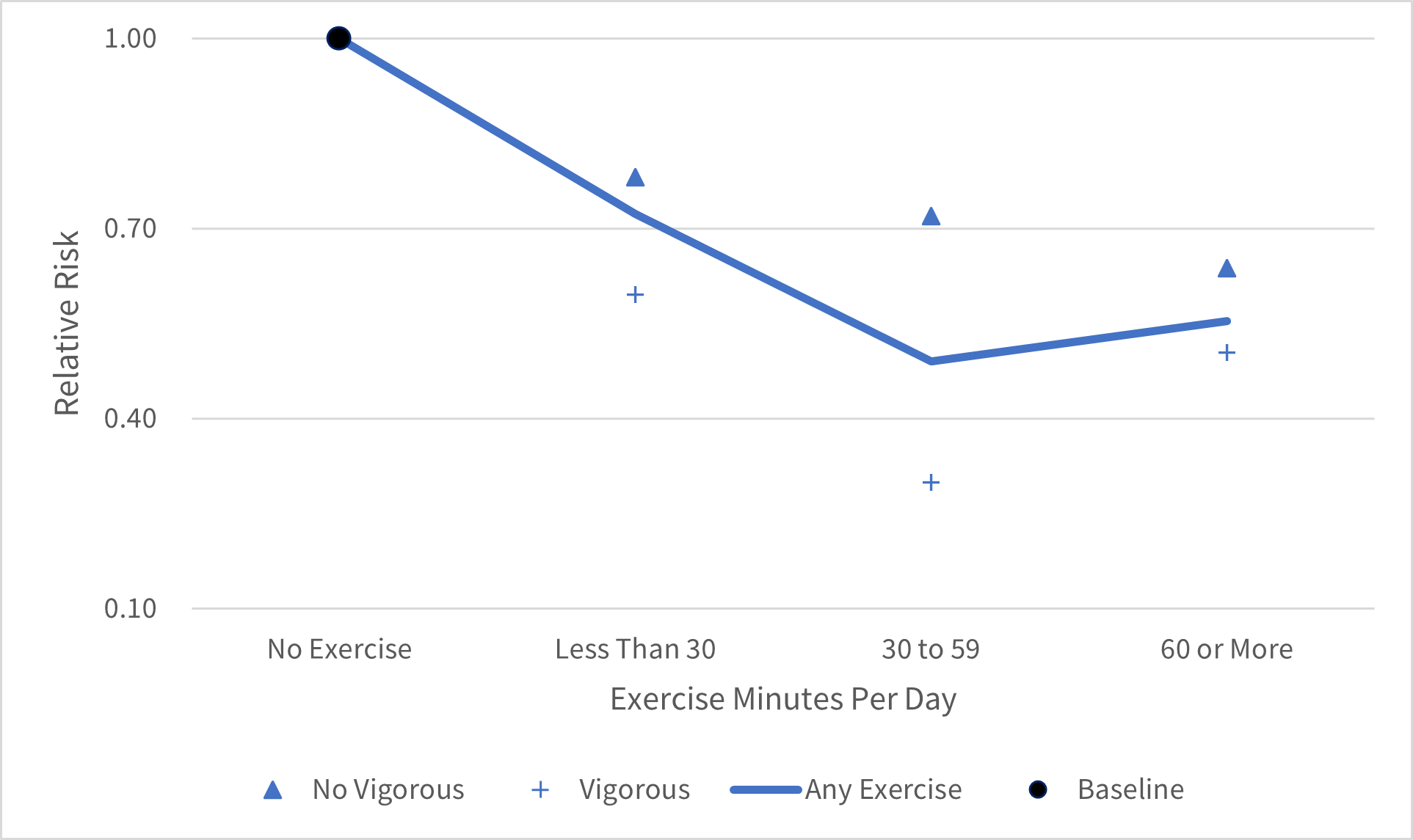

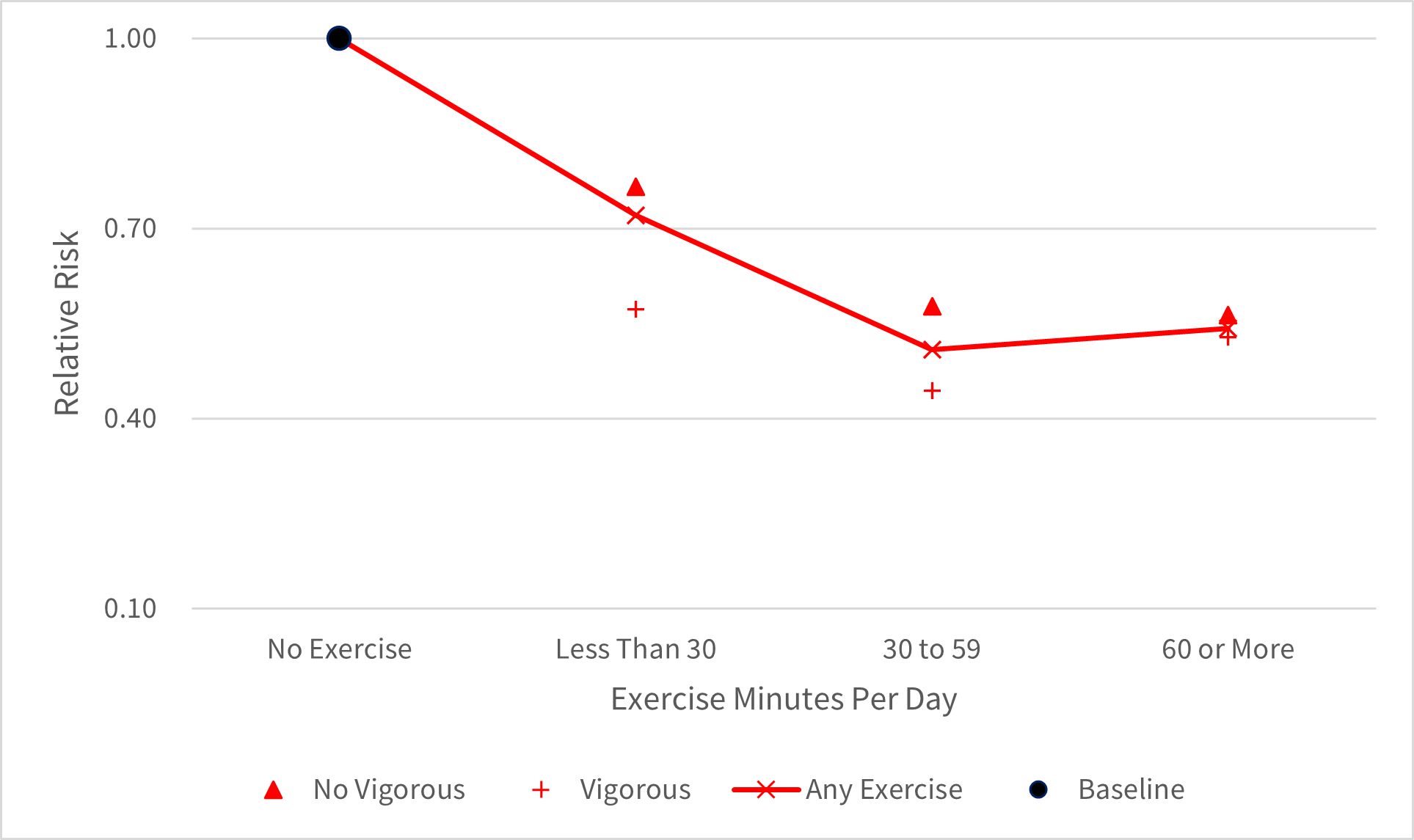

People incorporating vigorous exercise (such as high-intensity sports or fitness activities) into their regimen generally experienced even better health and lower medical expenses than more moderate exercisers, as seen in Figures 2 and 3.

Figure 2: Exercise Intensity and Relative Risk of Hospitalization, Male

Figure 3: Exercise Intensity and Relative Risk of Hospitalization, Female

While these graphs represent experience for all lives, additional analyses were performed for many subsets that included healthy and impaired lives (persons whose physical condition, according to insurance ratings, is below that required for insurance at standard rates). It was found that the positive effects of physical activity are generally more pronounced in impaired lives than in healthy lives.

These findings support the potential for offering premium discounts based on an applicant’s level of physical activity. However, it is important to note that actual discounts within any insurance program should be confirmed by a traditional pricing exercise to reflect the mix and distribution of the portfolio relative to demographic patterns within the market. For example, in regions where insured populations are more active,4 such as many markets in Asia, discounts will likely be lower than in less active regions, such as the United States.

Sleep

The research reveals an association between medical experience and sleep patterns. Studies have long associated sleep deprivation with a higher risk of heart disease, diabetes, obesity and other chronic physical and mental health conditions. RGA’s analysis5 identifies an optimal range of six to nine hours of sleep per night—those with sleep patterns outside of this healthy range pose a much higher risk of hospitalization and utilization of mental health services.

It is interesting to note that too much sleep is associated with poorer mental health than not enough sleep, as shown in Figure 4. This finding highlights the need to explore the cause and effect further: Do people sleep a lot because of an underlying mental health disorder, or is excessive sleep an early sign of such a disorder?

Figure 4: Sleep and Relative Risk of Medical Utilization

Pulse Rate

The study identifies a correlation between reduced medical expenses and a heartbeat lower than 60 beats per minute. Conversely, pulse rates of 80+ were associated with a significant negative effect, as shown in Figure 5.

Figure 5: Pulse Rate and Relative Risk of Hospitalization

Combining All Measures

Perhaps most importantly, combining all three measures—physical activity, sleep duration and pulse rate—can help insurers more effectively segment risks and identify preferred classes. For example, in Figures 6 and 7, the solid lines in the middle represent hospitalization-relative risks if considering exercise duration only. However, a wider profile difference is seen by further splitting the group into those with optimal sleep and pulse rate and those without, which helps to better classify risks.

Figure 6: Lifestyle Factors and Relative Risk of Hospitalization, Male

Figure 7: Lifestyle Factors and Relative Risk of Hospitalization, Female

Research into the impact of lifestyle factors on medical expenses can help drive the development of more cost-competitive and customer-centric health insurance propositions. For example, insurance-linked wellness reward programs could be embedded directly within a range of products to offer premium discounts or other rewards, such as gym memberships at reduced cost. Such incentives not only encourage healthier behaviors but can also enhance policyholder engagement and reduce lapse rates.

Insights from lifestyle data could be used to qualify clients for upsell and cross-sell offers, including additional health benefits and extended or more affordable coverage. Insurers also could develop customized solutions for niche segments, such as impaired lives who adopt healthier lifestyles.

Lifestyle data may also inform—and enhance—underwriting and claims processes. With the correlation between lifestyle factors and medical expenses now more firmly established, reducing or even replacing some of the traditional medical test requirements with lifestyle data in select markets may be possible. This could help in simplifying, as well as accelerating, the underwriting process.

Insurers also could use wearable data to proactively monitor and improve their health portfolios by offering disease management support, especially for impaired lives, in an effective and timely manner. This would not only help reduce medical claims but also improve the quality of life for policyholders.

Weighing Considerations

As promising as lifestyle data may be, insurers would do well to pause and weigh several practical considerations.

- Is there enough data? First, it is important to ask whether lifestyle data is readily available. Smart devices have only recently entered certain markets, and their use is uneven globally. For this reason, insurers may consider prefunding such devices in select markets if a cost-benefit analysis of potential claims savings could justify the expenditure. However, insurers should also be aware of the risks linked to reliance on and authenticity of new data sources, including the possibility that this data may prove to be unreliable or inconsistent.

- Are we allowed to use the data? Perhaps most importantly, when evaluating any novel data source, insurers must balance the appeal of new insights against the need to ensure data security and comply with local and regional regulations. For example, if regulatory review of product definitions or premium rates is typically required, it would be logical to assume this level of review would be required for lifestyle data-based propositions as well. Beyond regulatory concerns, carriers must also meet customer expectations for fairness, trustworthiness and transparency in how personal data will be collected, protected, used or—just as importantly—not used.

- Can we work with the data? Just because the data is available and allowed to be used does not necessarily mean an insurer has the ability to use it. Insurers would do well to assess their data collection, storage and analysis capabilities to confirm whether existing administrative systems and operating processes are adequate to manage an influx of such data. In addition, it may be necessary to identify any conflicts with existing rewards programs.

Health insurance ecosystems (HIEs) offer an attractive route to overcome many of these operational obstacles. The term HIE refers to a network of digital platforms designed to deliver health care services and product offerings to insured members. Uniting digital health services, such as symptom triage, telehealth and wellness programs, within a single framework empowers the insurer to achieve administrative efficiencies while gaining a deeper understanding of each customer’s needs and customizing product and service offerings accordingly.

Conclusion

The rich store of real-time lifestyle data collected by wearables presents a largely untapped opportunity. RGA’s analysis suggests lifestyle factors—specifically physical activity, sleep duration and pulse rate—could help insurers more accurately underwrite applicants, enhance the customer onboarding process and, ultimately, expand the role of health insurance.

This research suggests meaningful premium discounts are possible for health insurance customers. More importantly, attractive and affordable wellness initiatives could empower policyholders to embrace healthier habits and reduce the incidence and severity of chronic diseases. Insights from wearable data could also vastly improve the customer experience, from simpler, speedier underwriting to more efficient claims and disease management and more engaging reward programs.

Success is not assured, and insurers will likely need to balance operational, regulatory and administrative challenges against potential rewards. Regardless, the future of this emerging data is promising.