Insurance companies are assessing ways to integrate artificial intelligence (AI) and machine learning (ML) into their businesses to increase efficiency, and underwriters are a crucial part of that implementation.

While machines can perform certain underwriting tasks to speed the insurance process, human underwriters’ experience, knowledge and expertise remain invaluable components of augmented underwriting programs. But how can underwriters best engage with rapid advances in data science and technology? As companies seek to automate aspects of their underwriting programs, it is important for underwriters to have a baseline of knowledge for what is ahead and to help navigate any potential barriers to successful implementation.

Progress seems to be occurring quickly, especially in the wake of the COVID-19 pandemic’s disruption of traditional processes. There are many exciting things happening in the area of data technology, and the potential impact on underwriting is just beginning to be realized.

Yet with something as complicated as a facultative application, for example, machines cannot mirror the complex evaluation that highly skilled underwriters must complete. Facultative cases, almost by definition, have inconsistencies and nuances to consider and require in-depth knowledge of complex medical conditions in order to approve and assign a risk class. Such cases often demand a painstaking review of complex and sometimes conflicting pieces of information using comprehensive knowledge and nuanced judgment only possible by a human.

However, the same facultative underwriters whose judgment and perspective are required for nuanced and unique cases often have some of their time devoted to repetitive, tedious tasks. This is where AI technology can step in. Insurance companies are learning how to best leverage new data sources, predictive modeling, and machine learning to further automate the underwriting process so that underwriters can be freed up to use their expertise where it is most needed.

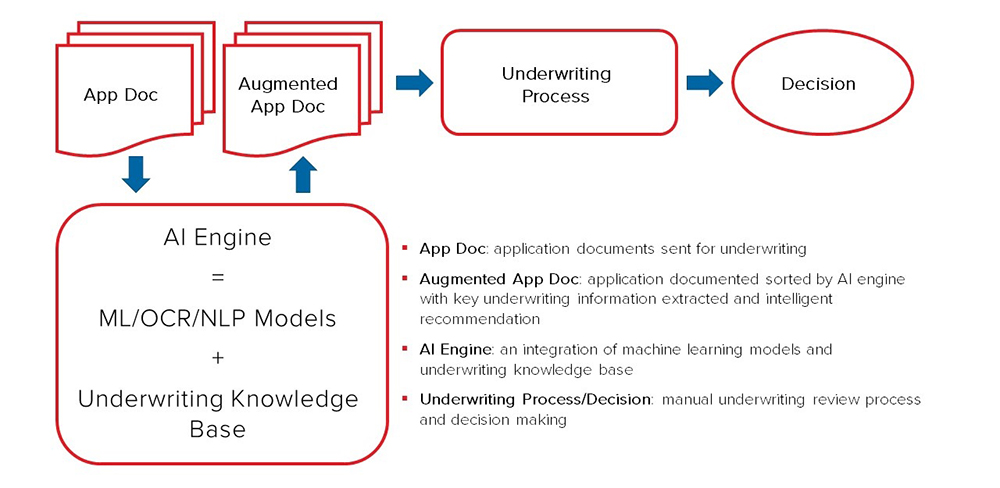

Computers are very good at repetition, and AI is about using intelligent repetition to recognize patterns and adjust to them – to learn without being directed at every step. However, as mentioned above, underwriting is extraordinarily complex, and currently no AI technologies available could fully underwrite a facultative application. Instead, multiple AIs – such as various voice, image, face, character, and translation algorithms – can be used as building blocks to support underwriters. At RGA, we have developed an AI Augmented Underwriting System solution stack. The solution leverages multiple ML/AI technologies, such as neural networks and natural language processing (NLP), to organize and interpret application documents. The AI system integrates both ML models and human underwriting expertise (Figure 1).

Building an effective end-to-end AI-based underwriting solution with today’s technology would be exceptionally difficult and not its most effective application. Instead, finding AI applications that would benefit-focused areas of the process is currently the more cost-efficient route. By working closely with underwriters to identify their needs, data scientists help to identify the workflow for a typical underwriter and examine the process, the data to be reviewed, and any challenges they may encounter.

One of the most common challenges faced by underwriters is the time-consuming manual review of imaged underwriting requirements, requiring both visual review and transcribing work. Each part of the task uses different functions of the brain – the eyes to see the page and the actual reading and processing of the information on the page. Using AI, these actions can be broken down to independent tasks: optical character recognition (OCR), a form of AI that can find patterns and images, and natural language processing (NLP), which can mine text for sequences of words. By then converting that information into a more concise, easily understandable format, these AI functions can help to augment the underwriter’s evaluation process and facilitate case reviews.

Returning to the example of a facultative case, some of these applications can reach into the thousands of pages that an underwriter must review. Using AI to scan such huge case files can, for example, identify pages where the underwriter may find medical impairments that cause concern or flag where an applicant or agent has inserted the wrong pages, randomly mixing in another applicant’s information. It can also allow for faster page locating, auto-population of data fields, or an automated search for inconsistent and contradictory information within an application. Such faulty information can include two dates of birth, incorrect page organization, mismatched ICD codes – the list goes on.

AI can increase the efficiency of the underwriting process in many ways. An augmented underwriting system can take in and analyze unstructured data from sources such as questionnaires, motor vehicle records, prescription histories, and attending physician statements. Performing tasks such as identifying names, locating signatures, and classifying pages make the cases more manageable for an underwriter, who reviews this output and makes a decision.

Data scientists can work together with underwriters to identify repetitive tasks that can be improved by integrating AI technologies. And by learning how to engage with and use new data sources and tools, underwriters can become a more integral part of a company’s evolving strategy. Skills and training that may be required of underwriters and data scientists to build and utilize these resources and technologies include:

- As a first step, underwriters and data scientists need to become more literate in each other’s languages. Solid and open communication is critical. Terminology is important, as it may vary from discipline to discipline.

- Underwriters need to understand the limitations of the model, and data scientists need to understand the limitations of the data from an underwriting perspective.

- Both underwriters and data scientists need to be keenly aware of potential blind spots, especially as it relates to bias.

- Underwriters need to be cautious about the hype around AI and avoid unrealistic goals for which the technologies are not ready.

- Data scientists need to design solutions that are guided by underwriting problems, not by complicated technology.

Underwriters of course serve a crucial role in the successful implementation of an augmented underwriting program. While a data scientist may be an expert in applying various data technologies or datasets, underwriters are best equipped to advise how these technologies can become ingrained within existing business processes. Working closely together, data scientists and underwriters can identify and build solutions that improve the underwriting process, while addressing challenges that could easily derail progress. Specific areas to aid in the successful implementation and application of data technologies within the underwriting process include:

Planning, prioritizing, and goal setting:

- From the outset, it is important to identify and set goals for an augmented underwriting program. This will aid in the buildout of the program and help select which tools and resources should be employed.

- Survey the underwriting team and identify the areas where current technology can help, and pick the technologies that can provide quick wins (i.e., small development efforts and high business value).

- Also, strategize on building a long-term program that utilizes a phased approach. Initially focusing on the big rocks and low-hanging fruit, then with a continuous improvement mindset, build upon the early successes to incrementally improve the solution(s) over time.

Engaging the experts:

It is clear that augmented underwriting can create optimized processes, operational efficiencies, expense savings, and improve the underwriting experience for both consumers and insurers, but nothing can replace the human mind and the invaluable role of the traditional life underwriter when it comes to critical analysis of complicated and unique cases. Augmented underwriting programs work best when they complement human skills, helping save the underwriters’ time and energy for the cases that need their critical thinking and expertise the most.