Insurance, generally speaking, is one of a few offerings where the service provider does not know at the time of sale how much it will ultimately cost them to provide.

To put it another way, the level of certainty a “widget maker” has regarding their costs and the profit they can make on a product does not exist for insurers. In pricing, actuaries have often relied on historical results to make future assumptions. In a world where new and innovative underwriting paradigms – with limited historical results available – comprise an ever-increasing portion of the new business written, actuaries’ reliance on underwriters’ experience and expertise has never been more central to the assumption-setting process.

Underwriting is not just straight underwriting anymore: It’s a partnership with the pricing and sales departments. As a colleague who works in business development put it, “Everything I’m selling is underwriting.” When a new product is introduced, prior underwritten cases and the expert risk assessment that went into them provide a much clearer picture of how key pricing assumptions will be impacted – a benefit of years of credible experience. With the industry evolving so quickly, actuaries can no longer rely exclusively on historical results, because they do not yet exist for many emerging solutions. This is where an underwriter’s perspective can identify common threads within given risk groups to be scaled up into rules and guidelines that enhance actuaries’ ability to develop more accurate assumptions and produce sustainable business outcomes.

Acceleration Through Collaboration

Many in the industry expected that accelerated underwriting would diminish the role of the underwriter, but reality continues to prove otherwise. While acceleration may take some of the easier cases off an underwriter’s workload, it still leaves the most complex cases requiring human expertise. In addition, the very nature of accelerated programs means actuaries do not have the same types or amounts of data available to determine pricing. With the speed at which some of these programs are being implemented, actuaries are learning as they go, which is where underwriters step in to help make connections among available data points and fill in the missing pieces.

Learn more: RGA Global Life and Health Underwriting Survey: Entering the “New Normal

Underwriters have had to cultivate a deep understanding of both the tools being developed and the pricing of related products, in order to see how their underwriting interacts with mortality assumptions. As products are developed in real time to meet market demand, it is a company’s experience in underwriting that provides a reliable foundation to help guide the process. Years of underwriting experience based on traditional underwriting principles, ongoing and advanced training, and collaboration with experts, such as medical directors and other colleagues, have enabled underwriters to gauge risk appropriately and provide confidence in assumptions even when evidence may be incomplete. As a result, underwriters today are able to draw on this experience in order to adapt to new and evolving data sources, thereby providing valuable input to actuaries in determining the loads and estimating the protective value of new, emerging tools.

Read more: Underwriting 2.0. - In an increasingly automated world, what does risk assessment look like?

Getting to this point has been an evolutionary process which is still unfolding. The initial introduction and integration of accelerated underwriting took a slower, more measured approach. Companies wanted to work through how applying these tools could result in similar accuracy in mortality risk assessment as traditional underwriting. There was an appreciation for the fact accelerated underwriting was new, credible experience was not yet available, and adjustments would need to be made when using fully underwritten experience to inform the development of assumptions. Adding to the challenge, many of the adjustments by their very nature could not be estimated from historical analysis.

Fast forward to today, alternative data sources and new predictive models seem to flood the market almost constantly. While alternative data is certainly more complex, it is often less complete. Insurers now need to determine what combinations of alternative data will effectively fill in gaps when traditional underwriting methods are not available. Underwriters now serve as the interpreters of that data, whose knowledge and experience can help decipher whether information is complete enough to make accurate assumptions. They apply their experience to bits of information in order to piece together a more complete picture. Without a structured way to put together the disparate data, underwriters’ analytical skills are crucial in enabling actuaries to make sound pricing decisions.

Read more: Developing a Successful Acceleration Road Map: Implementing Accelerated Underwriting

Take for instance, digital health data (DHD) and electronic health records (EHR). This is an area where the insurance industry ties underwriting experience to mortality in order to properly assess ratings and assumptions. DHD consists of hundreds of thousands of codes from multiple code sets and various medical vocabularies. Effective underwriting with DHD requires a deep understanding of risk associated with each code and careful analysis. For example, RGA created a comprehensive, purpose-built platform that consumes structured DHD from clinical and claims data and assigns severity scores according to their underwriting philosophy. The end result – reams of indecipherable information converted into a readily applicable underwriting risk score. To measure how effectively the score captured the salient elements of the vast data inputs, actuaries were engaged to perform a mortality study, demonstrating quantitatively the different levels of mortality risk identified by the score.

Industry-wide, reinsurers are working towards finding solutions that are able to extract data and turn it into meaningful underwriting tools to help with risk assessment. They are endeavoring to figure out how to best package data for the underwriter to easily view and make use of the information.

Keys to Success for Underwriters and Actuaries

Now that we’ve established why and how the actuarial function relies increasingly on underwriters, we would like to provide specific ways actuaries and underwriters can partner together to facilitate the exchange of knowledge. The following examples of underwriter-actuary collaboration provide proven approaches to capitalize on new opportunities and accomplish the end goal of assumption development and pricing of products.

Involve underwriters early: In evaluating new sources of data, involving underwriters early in the process can help with assessing how trustworthy the data is and whether there may be gaps. If the data is determined to be of sufficient quality, a scoring tool can help increase its usefulness, with an underwriter assuring the tool’s accuracy by reviewing the business and examining cases coming through.

Work together to establish rules: It is important for actuaries and underwriters to work together to identify the parameters and underwriting guidelines around specific data sets. By knowing the strengths and weaknesses of the evidence, the underwriter serves as the gatekeeper who can see the trends in action. For example, EHRs can be a good data source but only with the right parameters in place. If the data is 3 years old and has no other supporting evidence, that data really will not be helpful. However, if the records are within the calendar year, that will increase their relative value in making a decision.

- Notable benefits of co-created tools:

Established rules and specific parameters for when to apply those rules help the downstream pricing department. The rules are not intended to shackle underwriters to the actuary’s expectations, but rather to apply their underwriting judgment in a consistent manner and to hopefully make everyone’s job easier. Consistency in pricing/offers helps underwriters understand when they would need or expect extra requirements.

With clear rules, underwriters can more easily stay in line with regulatory requirements. Underwriting guidelines help ensure underwriters are treating similar impairments in the same way and help equip underwriters and companies to answer questions regarding decisions.

- Understand that knowledge is power: Underwriters should be educated about tools and resources so they can understand programs’ strengths and weaknesses and provide input as to how tools can be used most effectively.

- Maintain open communication at all levels: Along the same lines, senior underwriters should communicate regularly with actuaries. Actuaries need to know underwriters are getting enough information.

Monitor and manage: Whether implementing an accelerated underwriting program, a scoring tool, or other source of alternative data, effective monitoring and management are crucial to assess overall effectiveness. Note, some recent programs have been given a fast-track into production to accommodate COVID-19 and perhaps have not gone through customary pre-launch discussions and evaluations. Looking back and managing the program will be even more important.

Looking Ahead

COVID-19 has only highlighted the growing importance of in-depth underwriting knowledge and specialized expertise. As we continue to live through the pandemic and adjust to a quickly evolving industry, it is important for underwriters to broadly consider risk. The COVID-19 experience has hastened this evolution, compelling insurers to turn to new evidence sources and find new, contactless ways to underwrite customers without traditional paramedical visits and blood draws. The need to apply existing expertise while being open to new opportunities – and ready to learn and adjust – is now more essential than ever.

Read more: Both Sides Now: Sharing Group Claims and Underwriting Perspectives for Improved Efficiencies

The future of underwriting is being rewritten each day. To successfully navigate this rapid evolution and come out ahead, insurers will need their underwriters to work cross-functionally with actuaries to ensure the processes, programs, and partnerships being implemented are not only working toward a new era in underwriting but also protecting the value of their companies.

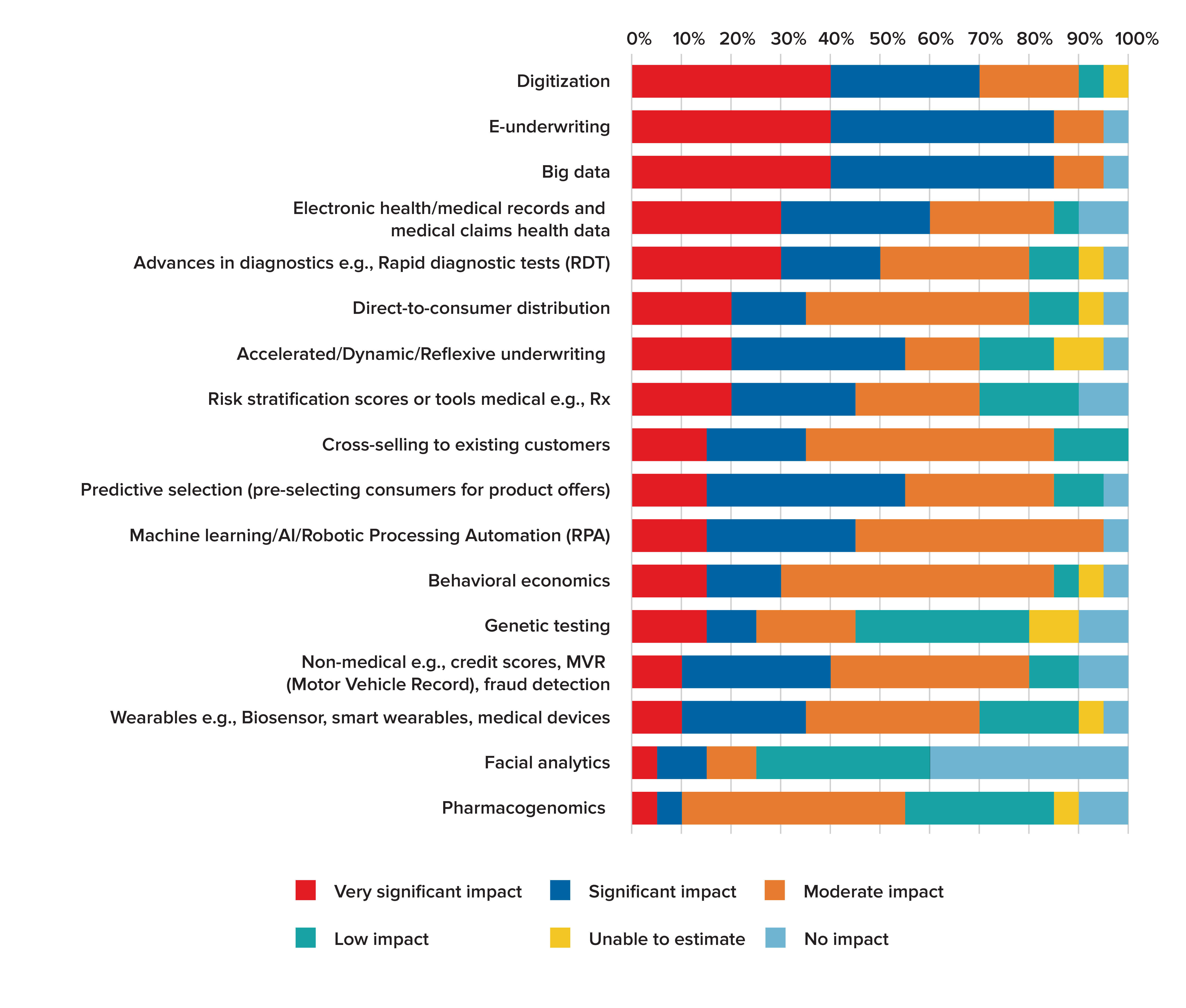

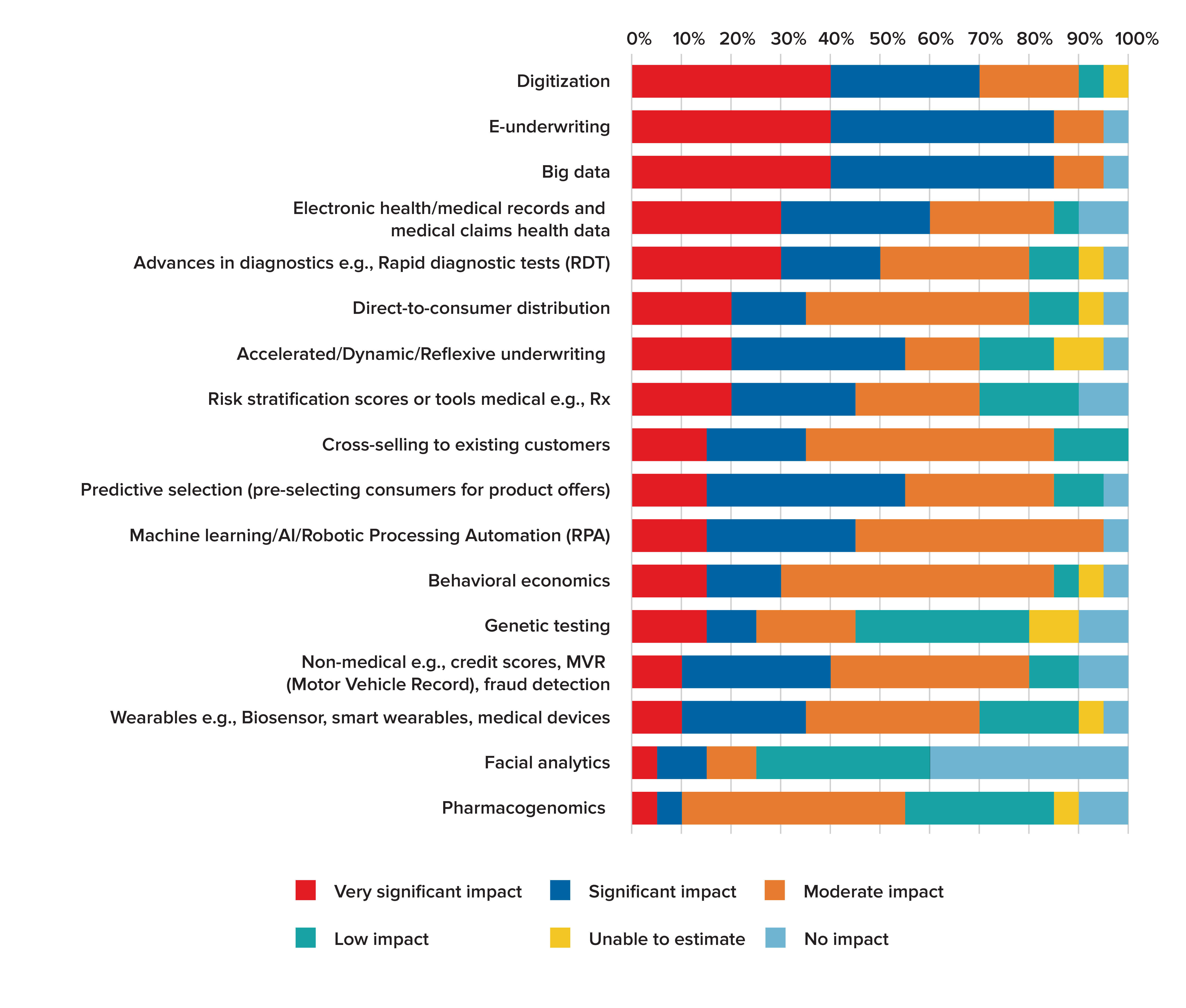

Figure 1: Future Impact of Innovations on Life and Health Underwriting Functions

According the Global Life and Health Underwriting survey completed by RGA in early 2020 (pre-COVID-19), while insurers reported greater use of common or more traditional data sources (90% of participants are using lab data today, and 65% are using prescription drug data), participants also reported a changed view of emerging data sources going forward. For example, 40% of respondents indicated they are planning to use medical health monitoring devices in the future as an alternative source of evidence. Digital health records are already used as a data source by 45% of respondents, with another 30% intending to use these records in the future. Composite scoring (blending multiple risk scores together) is used by 35% of respondents, with another 30% intending to use it in the future.