RGA’s global mental health survey discovered that demand is increasing for mental health products and services. Nevertheless, less than one third of respondents have launched new products and services to meet that demand in the last two years. More than 80% of survey-takers said underwriting was a contributing factor to their cautious approach to mental health products.

The issue is more complex, however, than underwriting guidelines and practices alone. Insurance products are developed through a combination of product, pricing, and risk, and are affected by a host of other factors, such as customer needs, operational objectives, healthcare infrastructure, and regulatory environments.

Historically, insurers declined or applied broad exclusions to many cases with mental health disclosure, often because of a lack of data or limited disclosures and supporting medical evidence.

As the insurance industry undergoes a major shift around mental health coverage, underwriters play a key role in the development and implementation of new philosophies and practices to align the risk assessment of mental health issues with wider business needs and direction.

This article will detail the underwriting findings of RGA’s survey, the specific challenges of assessing risk related to mental health issues, and some possible paths forward offered by insurers in more mature markets.

Underwriting updates are underway

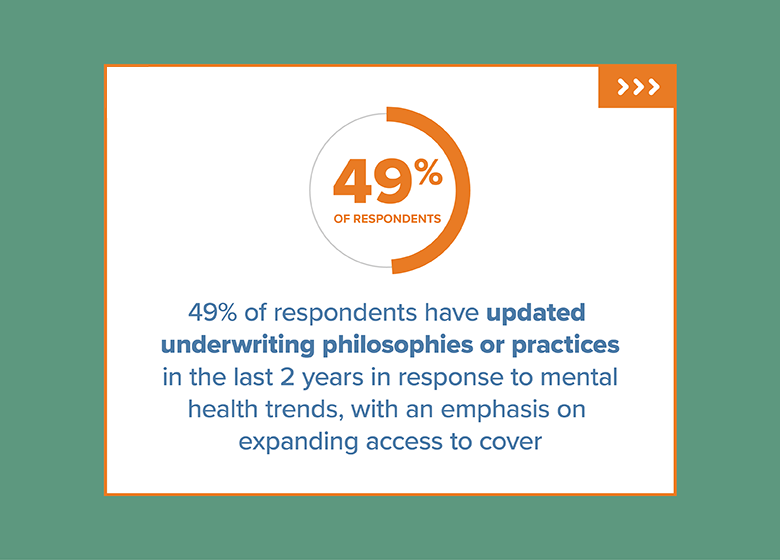

RGA’s survey found that the life and health industry is making progress in adapting underwriting approaches to widen the scope of acceptable risks for applicants with mental health conditions.

- 49% of respondents said they have updated underwriting philosophies/practices in response to mental health risk in the last two years.

- 48% intend to update their underwriting philosophies/practices around mental health risk in the next two years.

This renewed commitment to modifying underwriting practices represents a significant shift in the risk management of mental health issues and a recognition of the important role underwriting can play in increasing access to mental health products and services.