Longevity swaps are the most common instrument to transfer longevity risk. The first longevity swaps were executed in the U.K. more than 15 years ago. Notwithstanding the increasing number of countries in which longevity risk has been transferred, most longevity reinsurance transactions are still executed in the U.K.

Although the number of longevity risk transfers executed to date in the Netherlands is small compared to the U.K., the size of some of these Dutch transactions is very substantial compared to those in the U.K.

The longevity risk transfer market in the Netherlands has seen some interesting developments. This article details some of these developments. It further describes some recent features that have been included in longevity swaps. Finally, we zoom in on the increased interest of Dutch insurers in extending longevity risk transfer with asset performance risk, referred to as asset-intensive reinsurance, and how this may result from the changes in pension regulations as currently debated in the Netherlands.

From Derivatives to Reinsurance

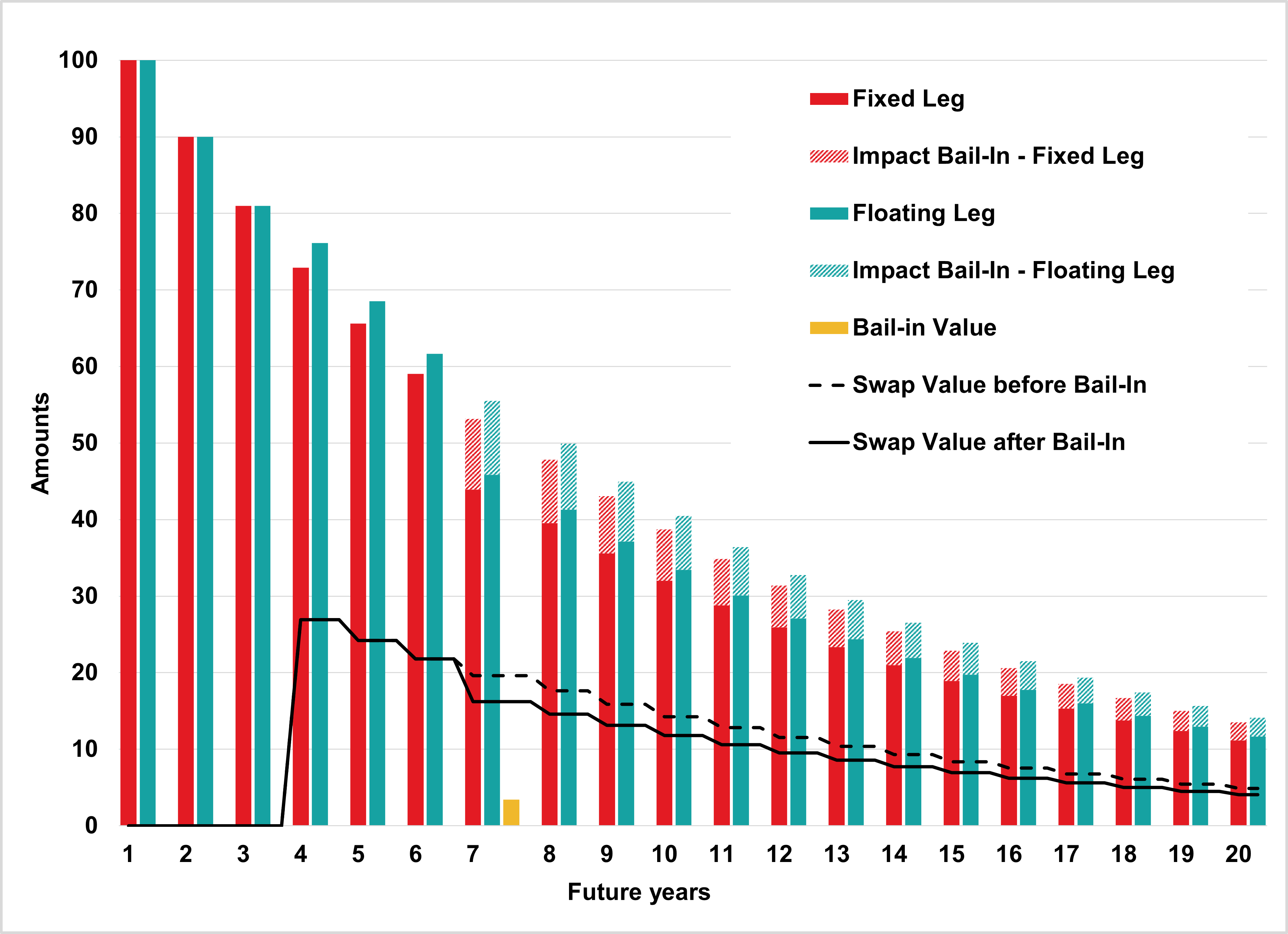

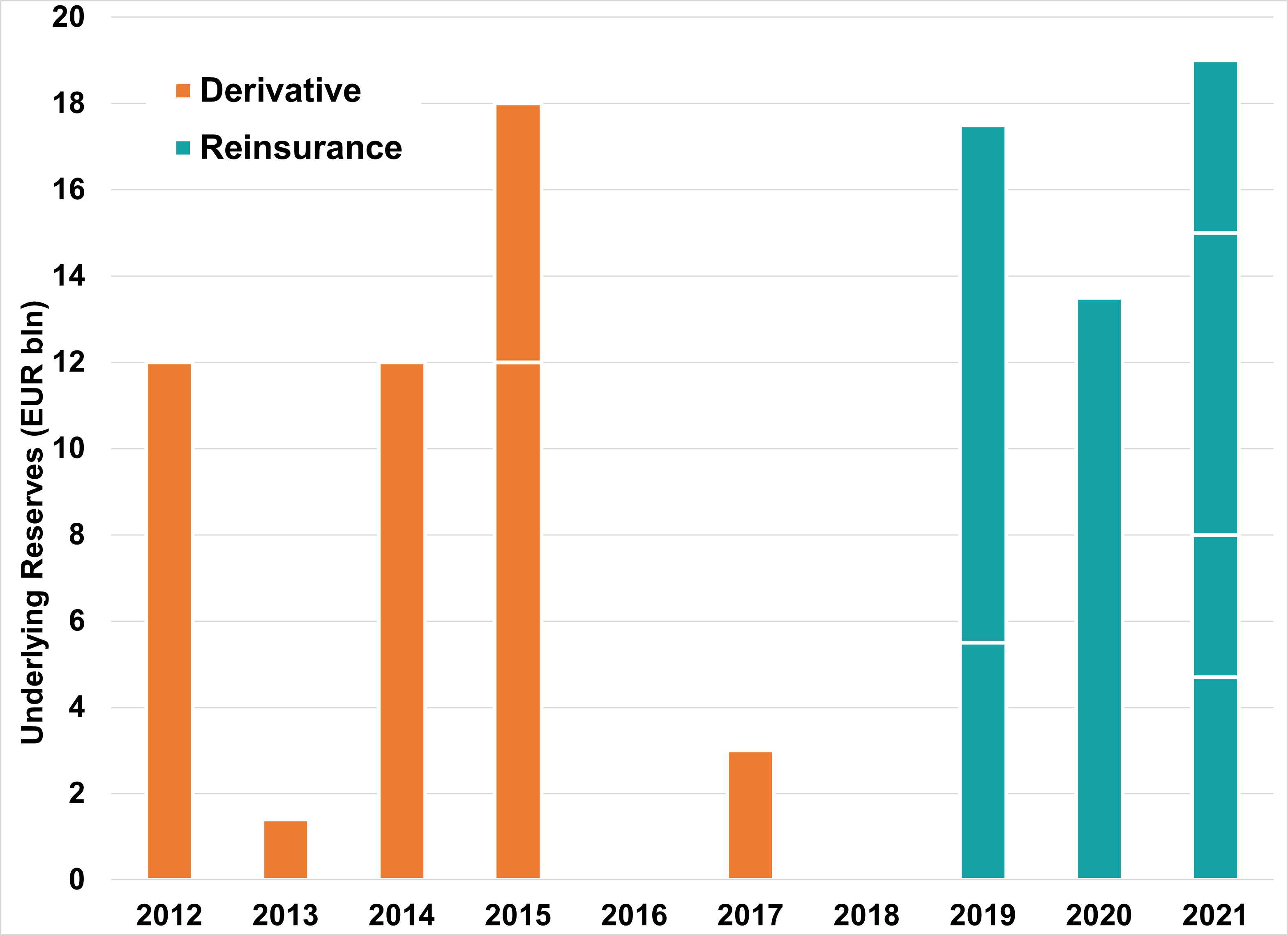

Over time, insurers in the Netherlands have accumulated sizeable portfolios of pension obligations that are subject to longevity risk. Figure 1 contains the longevity risk transfer transactions implemented by insurers in The Netherlands.[1] Each bar corresponds to a single transaction and the size of the bars refers to the underlying reserves.

Figure 1:

Longevity Risk Transfer in the Netherlands

Figure 1 shows that the first longevity risk transfer transactions implemented in the Netherlands were longevity derivatives[2]. These longevity derivatives are based on the mortality risk of the general Dutch population, as opposed to a specified portfolio of insured beneficiaries. In addition, these longevity derivatives are structured to transfer more remote (out-of-the-money) longevity risk over a limited term and the benefit (claim) under these longevity derivatives is capped at a pre-defined amount.

Compared to longevity reinsurance, longevity derivatives require only a limited set of data to be shared with the risk takers and impose less due diligence requirements on the ceding company compared to a reinsurance transaction. On the other hand, it is more challenging to determine the reduction in Solvency Capital Requirement (SCR) under Solvency II (SII) resulting from these derivatives because there is no perfect fit between the longevity risk transferred and the longevity risk of the insurance company.

Figure 1 also shows that over time Dutch insurance companies moved from longevity derivatives to longevity reinsurance, referred to as longevity swaps. Despite the term “swap,” these transactions are indemnity reinsurance transactions, based in the insurer’s liabilities for a specified portfolio of insureds. These longevity swaps do not have a maximum term and no maximum benefit.

As longevity swaps transfer all the longevity risk of a specified portfolio of pension obligations over their full remaining term (which can easily be more than a few decades), these transactions are more expensive than longevity derivatives. On the other hand, because these reinsurance transactions exactly match the underlying liabilities of the insurance companies, these instruments allow insurance companies to fully release the SCR for the corresponding longevity risk.

There are different reasons for the move from longevity derivatives to longevity reinsurance in the Netherlands. One of these reasons is the introduction of SII in the European Union in January 2016. SII has an explicit SCR for longevity risk which resulted in clear capital relief from longevity risk transfer transactions. This was not the case under the prior regulatory regime.

Recouponing in Longevity Swaps

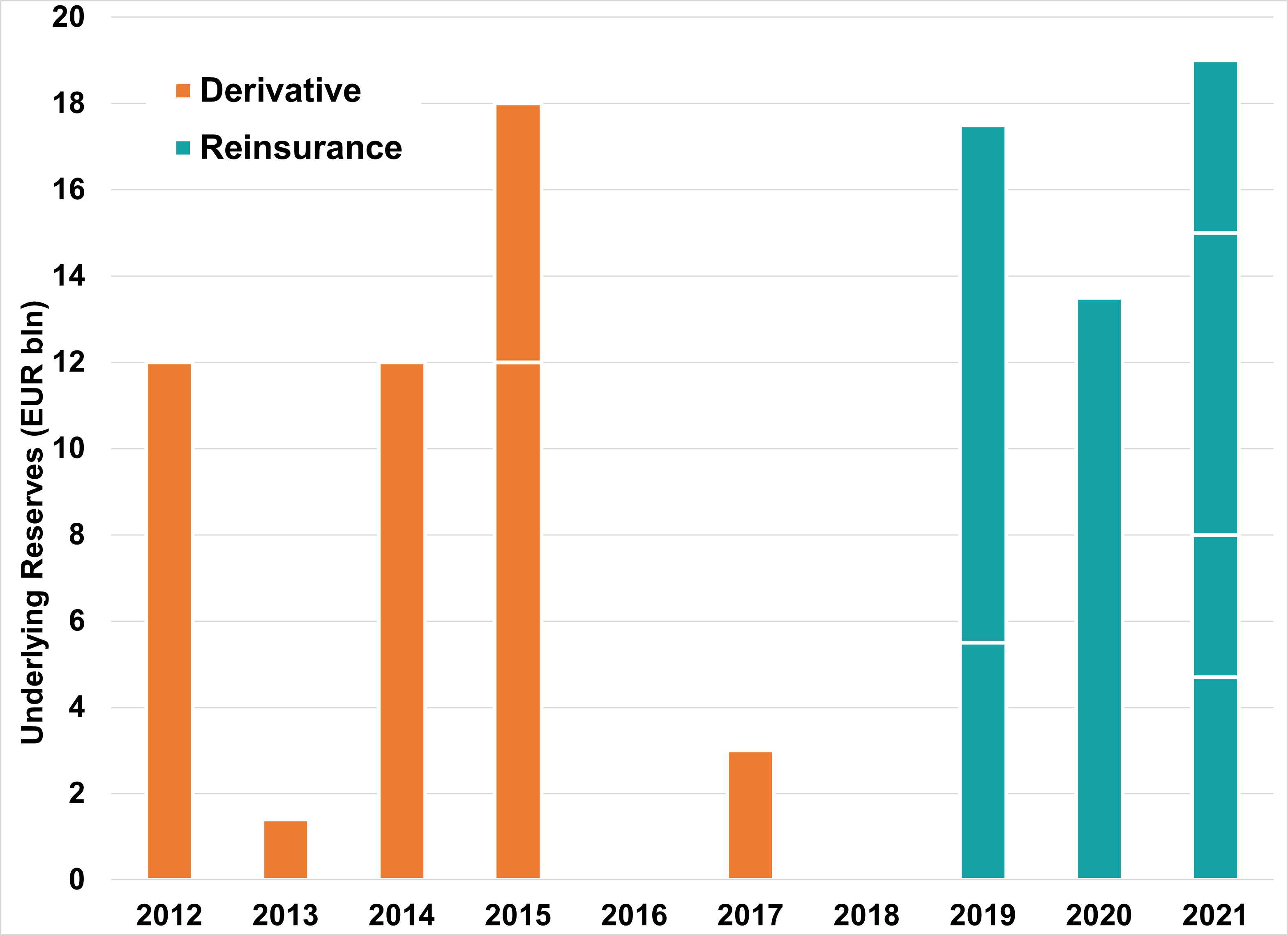

In recent longevity reinsurance transactions an adjustment mechanism has been incorporated that is referred to as recouponing (or rebalancing). The objective of recouponing is to provide additional protection to the party that is facing a positive value of the longevity swap at a future moment during the term of the transaction. Under this mechanism, the fixed leg (the premiums) of the longevity swap is adjusted in case its present value has become materially different (either higher or lower) compared to the prevailing present value of the floating leg (the claims).

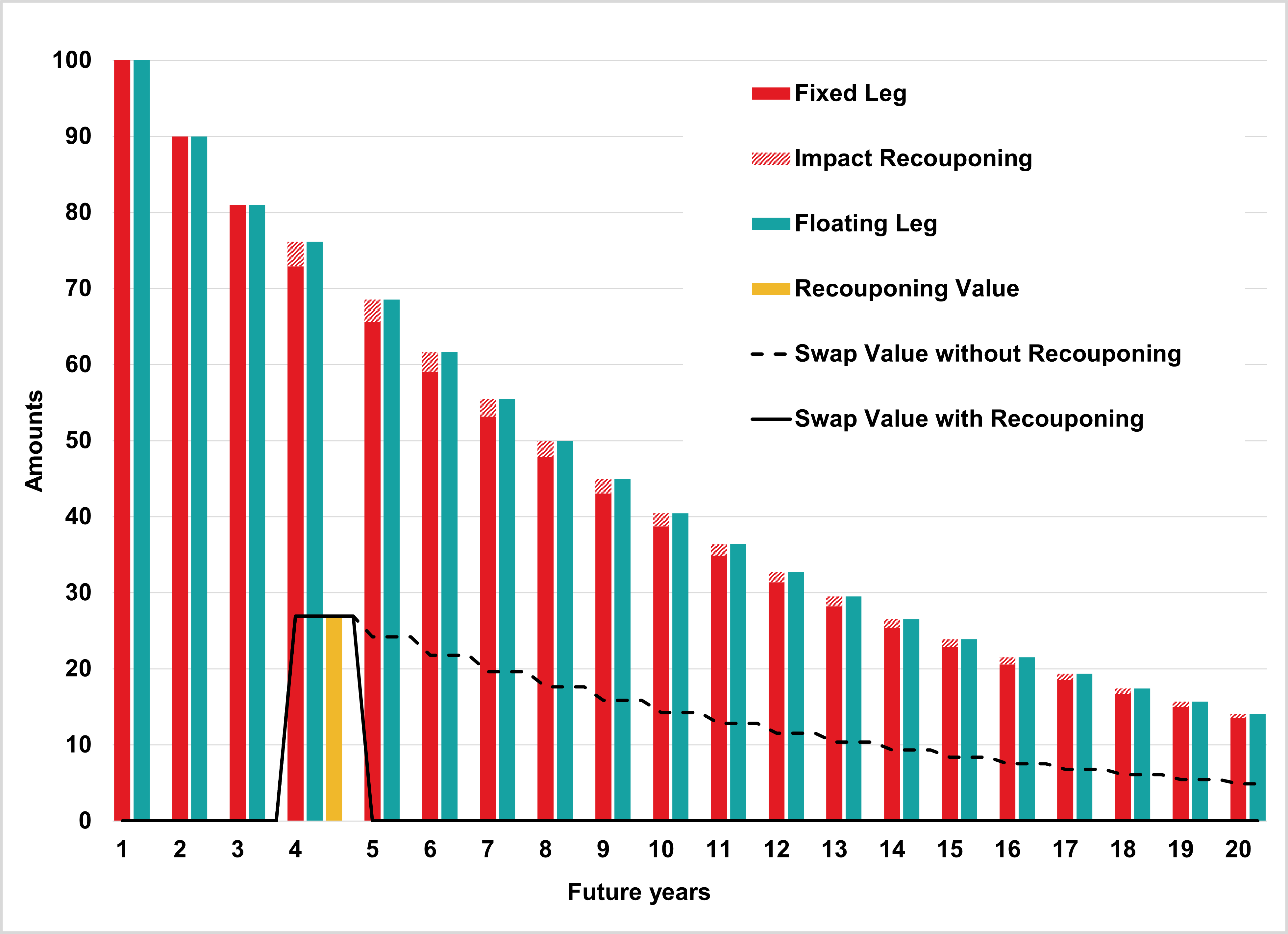

To illustrate this, consider a simple example of a longevity swap between an insurer and a reinsurer with the fixed and projected floating leg for the coming years as reflected in Figure 2. At inception these two legs are equal, which results in a zero value of the swap (ignoring the cost of the longevity reinsurance). Subsequently, we assume in the fourth year, a material reduction in projected future mortality which results in an increase of the projected floating leg (compared to the original projection). Therefore, the swap now has a positive value for the insurer: the receiver of the floating leg.

Figure 2:

Example to Illustrate Recouponing in a Longevity Swap

If the longevity swap is then adjusted based on recouponing, the reinsurer will pay the insurer the prevailing value of the swap, the recouponing value. In addition, the fixed leg is increased so that its value is (again) equal to the value of the floating leg. Going forward, the insurer will pay the adjusted (higher) premiums as part of the fixed leg. As the present value of these adjustments is equal to the recouponing value, recouponing can be seen as settling the current value of the longevity reinsurance in exchange for a change in future premiums with the same present value.

Although the objective of recouponing is to provide additional credit risk protection, it is already market practice to include a two-sided collateral arrangement in longevity swaps to mitigate the counterparty credit risk between the parties. This is because longevity swaps have a long expected term over which mortality can develop materially different than originally projected (in either direction). This experience collateral arrangement is based on a solid legal framework that is widely used in the global financial industry. Although one could argue there is no harm to incorporate additional protection, recouponing results in additional complexity and the need to lock in a discount curve to determine the recouponing value which would not be required otherwise. Therefore, such additional feature needs to be justified by convincing arguments to support it.

Accommodating a Bail-in

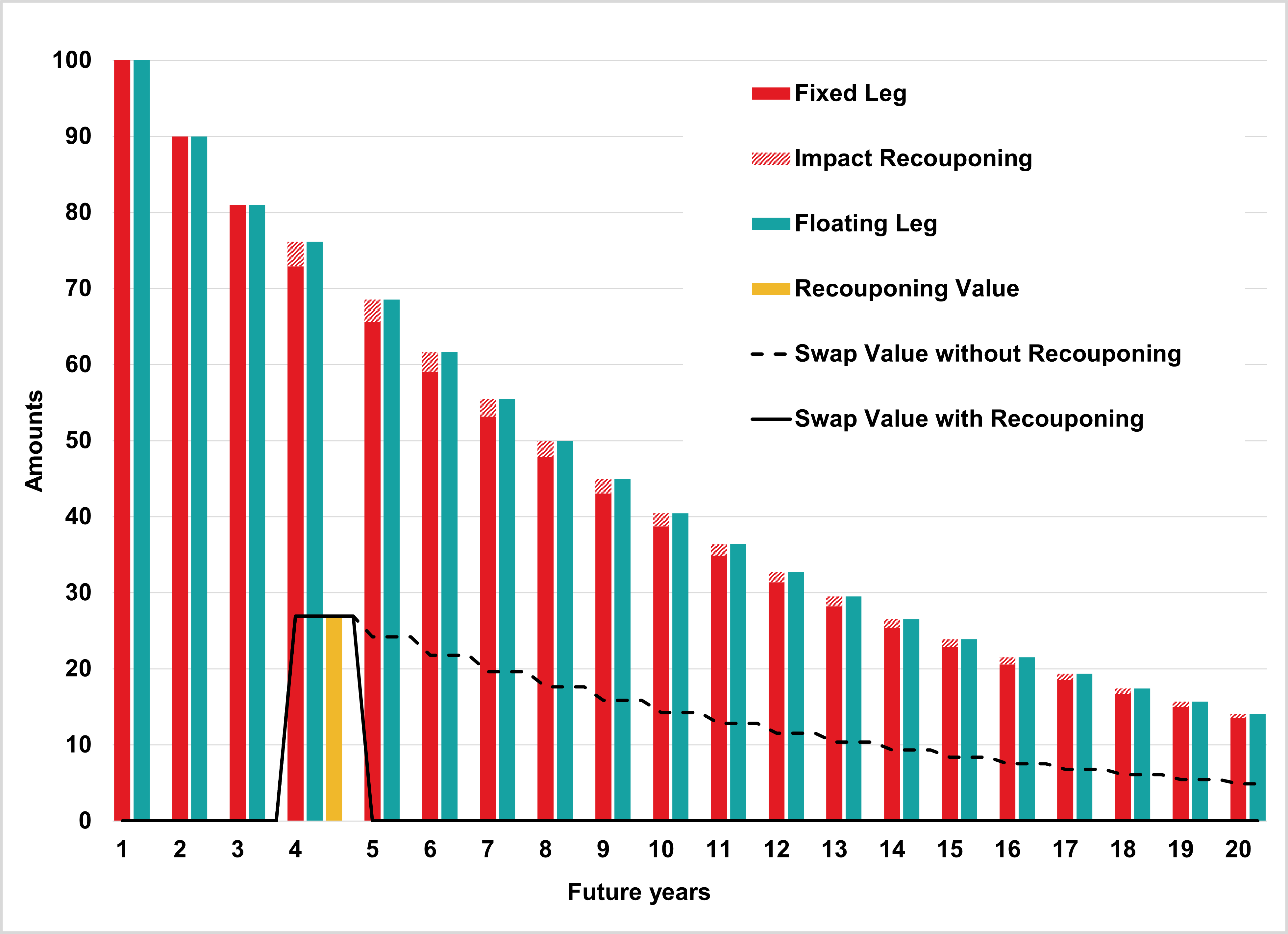

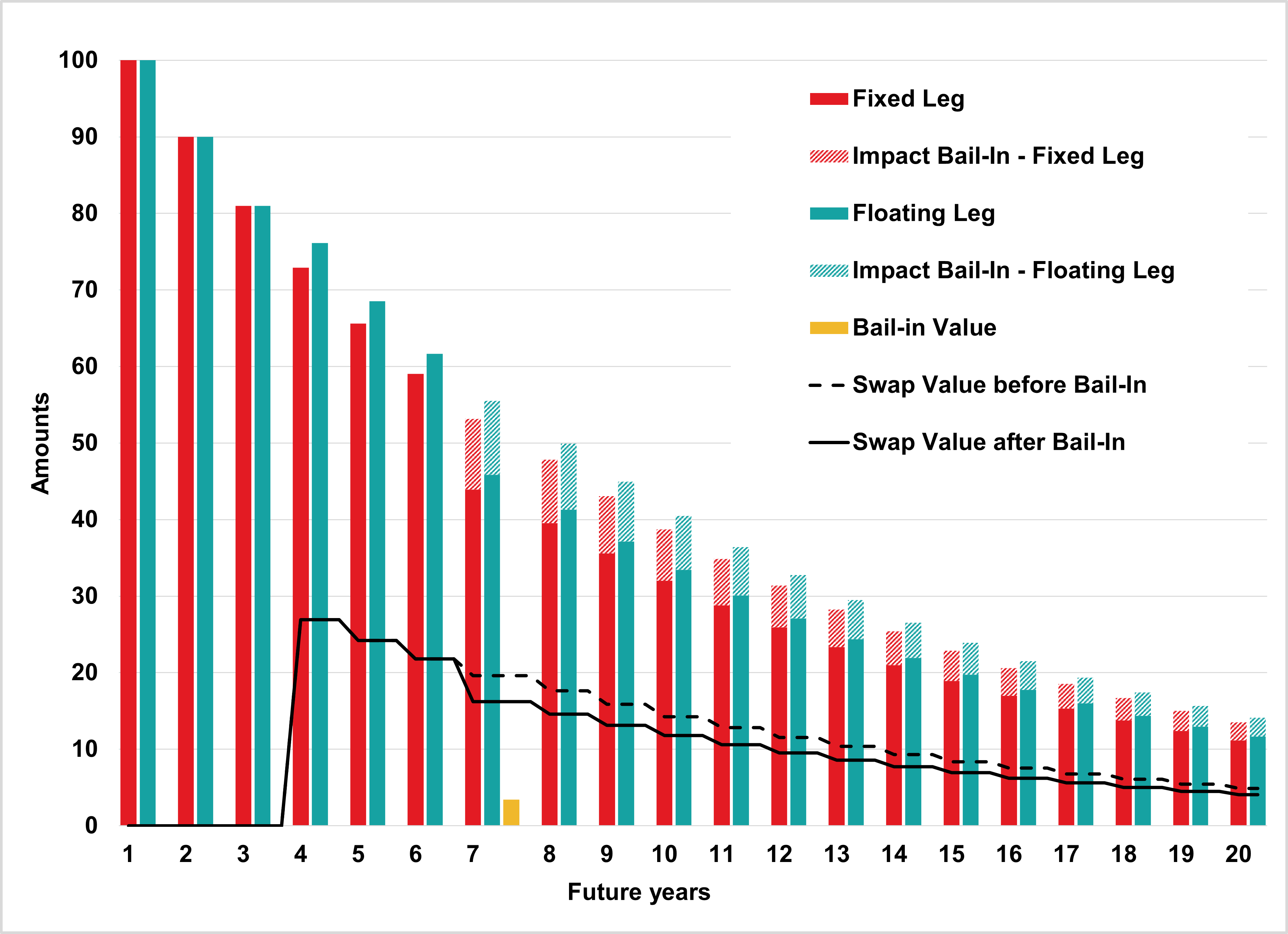

Another new feature in longevity swaps is accommodating a bail-in. Bail-in is one of the resolution tools included in the Recovery and Resolution Act for insurers as applicable in the Netherlands since 2019.[3]

In case of a bail-in, the insurer’s pension obligations might be reduced. The purpose of such reduction is to recapitalize the insurer so that its activities can be continued. The objective of the bail-in wording in a longevity swap is to specify the approach on how the reinsurance is adjusted in case the underlying pension liabilities are reduced because of a bail-in. Conceptually, such adjustment can be considered a partial early termination of the swap, namely for the reduction in underlying obligations resulting from the bail-in.

To illustrative this, consider the same example as before including a material reduction in projected future mortality in the fourth year of the longevity swap but without any recouponing (see Figure 3). We then assume a bail-in happens in the seventh year resulting in a reduction of the underlying obligations. Subsequently, both legs of the longevity swap are reduced accordingly and the reinsurer pays the insurer the value of the swap corresponding to the reduction in obligations, referred to as the bail-in value, and the longevity swap continues based on the remaining (reduced) fixed and the floating leg.

Figure 3:

Example to Illustrate Bail-In in a Longevity Swap