In the 25 years since its arrival in the industry, automated, or digital, underwriting has helped reduce inefficiencies and accelerate sales for insurers worldwide. Yet some insurers still hesitate to launch automated underwriting solutions.

Whether prompted by concerns about cost, fear of the unknown, or loyalty to existing processes, these insurers are missing out on the potential transformation of their underwriting strategy – a transformation that has enabled their competitors to achieve efficiencies, stabilize underwriting decisions, aggregate valuable data, and measurably improve the customer experience.

Many executives, underwriters, sales leaders, and actuaries are itching to take their underwriting systems to the next level. We know this because as the lead sales and account managers for RGA’s automated underwriting (AU) software, AURA NEXT, we have responded to thousands of questions via requests for proposals (RFPs) from insurers looking to take the next step. In this article, we outline the most common obstacles insurers have identified in considering an AU solution, along with our insights on how a custom AU system is implemented and scaled.

Common Obstacles

#1: “Too much money. Too few resources.”

It comes as no surprise that cost concerns are among the first objections raised around a new AU option – both the subscription cost of the software and internal resources needed to learn, launch, and administer it.

Yes, it costs money to adopt an outside platform, but once operational, it does not take long for the efficiencies of a digital solution to make up for its cost. For AURA NEXT, we have estimated that the break-even costs of the platform are often achieved at around 8,000-10,000 applications per year.

Additionally, most AU platforms offer flexible pricing models. For example, insurers can access a traditional subscription model, a transaction-based model where they pay for only the applications put through the system, or a model in which the system cost is rolled into a reinsurance treaty.

As for internal resources to adopt and lead the AU system, the resource commitment is modest. We typically request from our clients a core team of 5-8 dedicated professionals focused on the implementation. A typical project takes four to seven months with the team immersed in both a technical and underwriting workstream.

#2: “It’s too complicated to implement.”

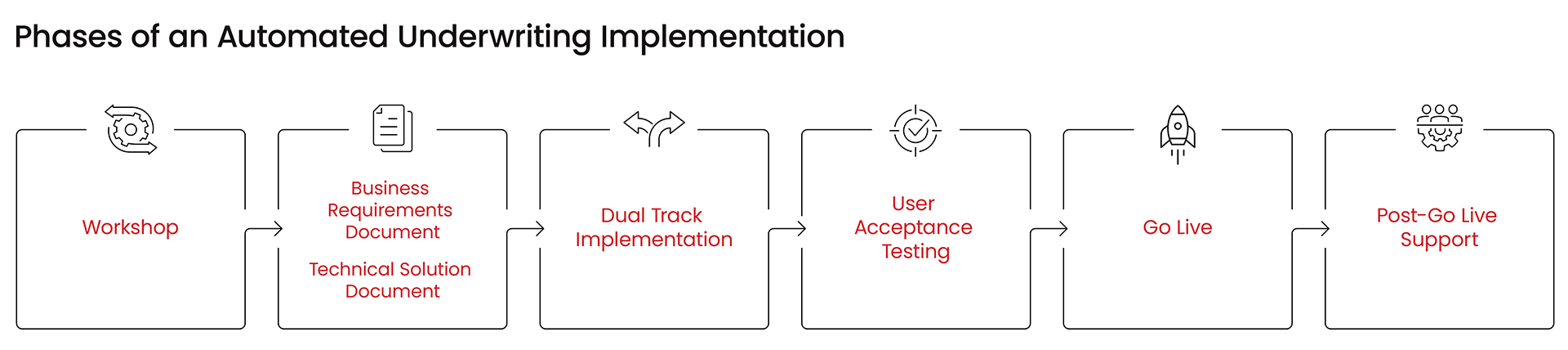

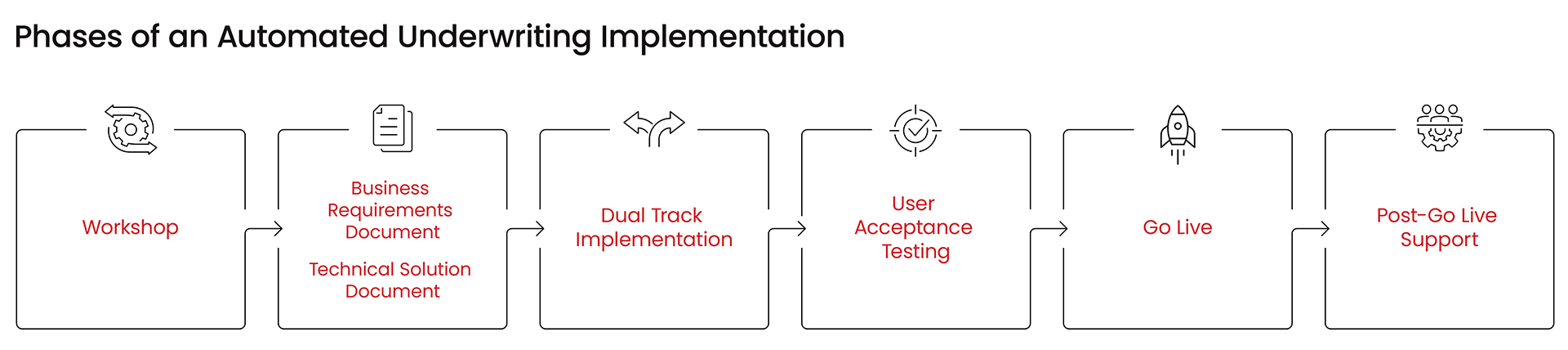

Any SaaS (Software as a Service) implementation takes time and effort, but an experienced software vendor should lay out a clear plan that has proven successful for other clients. RGA has implemented AURA NEXT dozens of times. Over those rollouts, we have standardized the process and frequently collaborate with our client teams to apply their specific deployment methodologies and processes.

Some insurers contend that their unique market position is not suited to a standard AU implementation. While markets have unique characteristics, we have discovered that, even globally, customers are demanding similar features that can only be provided by digital underwriting processes.

These demands include point-of-sale decisions, improved customer experience, better user journeys, the ability to buy via mobile platforms, and the rapid delivery of policies and new products. Additionally, AU systems should allow insurers to set underwriting rulesets for different regions or business units, allowing for customization at the local level while still reaping the benefits of a centralized system for data collection.