To many people, life insurance is the picky eater’s bitter pill or nasty vegetable that parents attempt to disguise in their children’s favourite treats.

A popular cookbook series focuses on ways to hide sweet potatoes in macaroni and cheese, or spinach and blueberries in brownies. Crushing up pills in pudding is another tactic to hide the taste of doing the right thing. At some point, however, a child needs to choose to eat the “good stuff”.

When it comes to insurance, many life insurers are struggling with this same issue: Carriers have not been able to get many consumers to move past the perception of life insurance as a bitter pill or a nasty vegetable, rather than a solution to a key financial problem. And in today's economic climate, insurance brings increased value as a potential antidote to runaway inflation and rising financial insecurity. This is a massive, missed opportunity: Insurance is perhaps the most undervalued financial asset and the most underrecognized savings program for retirement in the United States.

This is a massive, missed opportunity: Insurance is perhaps the most undervalued financial asset and the most underrecognized savings program for retirement in the United States.

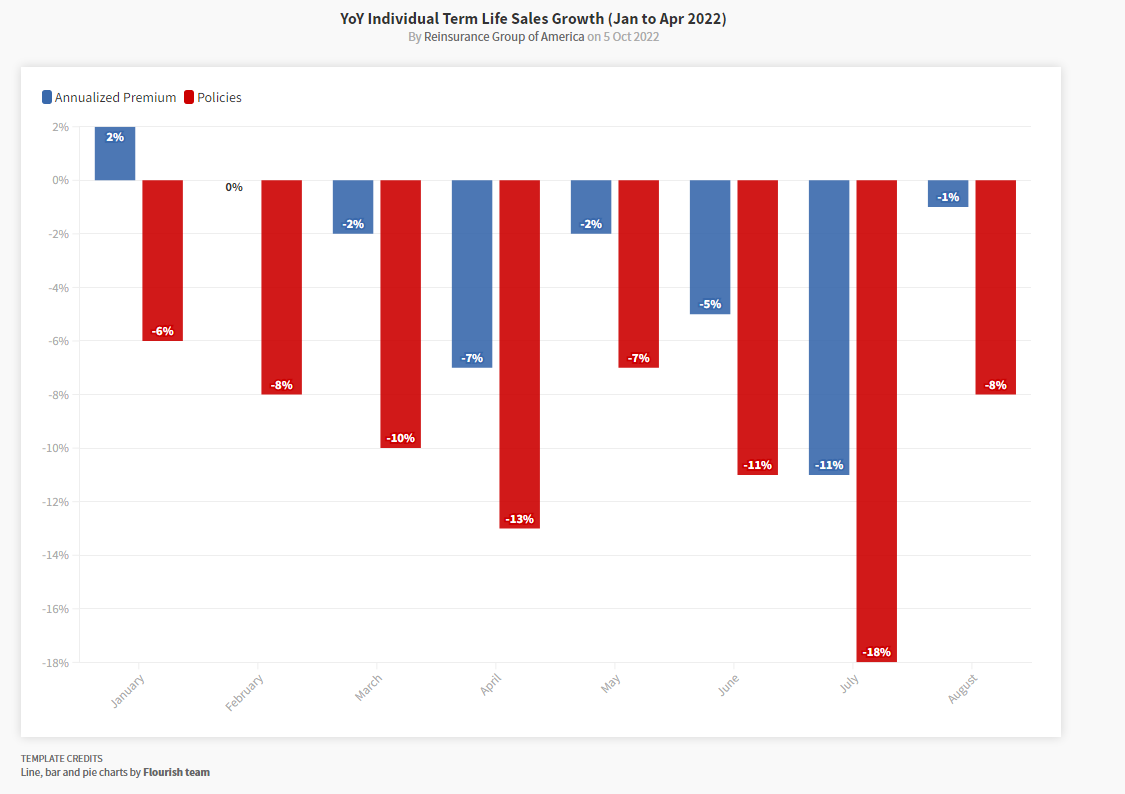

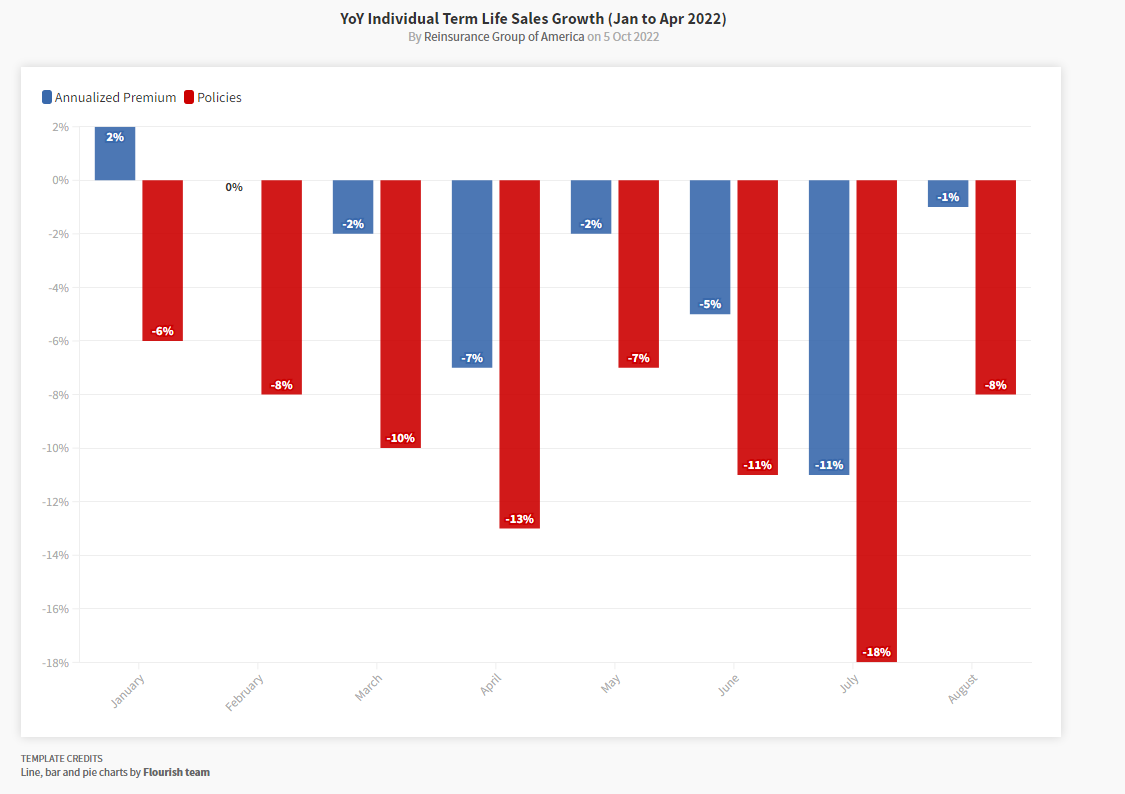

Yet while rising prices, supply-chain disruptions, and mixed economic signals are big pills for today’s consumers to swallow, surveys suggest life insurance is often perceived as an even bigger one. U.S. life insurance applications declined 6.5% year to date through mid-August 2022, compared with the same period in 2021, according to data from LIMRA (figure 1). It's not hard to understand why. Only consider the premise of coverage: The policyholder must contemplate his or her death and sacrifice short-term gratification to pay for the long-term gain of loved ones. The insured never sees the benefits of his or her premiums. That’s not easy in the best of times; it can be even tougher when wallets are lighter.

Instead of addressing this barrier by presenting a life policy’s intrinsic value, many insurers focus solely on camouflaging coverage within other offers or on emphasizing the convenience and speed of a digital purchasing experience.

Embedded insurance, fluidless application processes, and digital distribution can be extraordinarily powerful techniques – but those alone cannot change the underlying product. These features are limited in their long-term impact on purchasing behaviour. In a crisis, such as the COVID-19 pandemic, purchases may surge, but once the emergency ends, sales too often stagnate.

Instead of addressing this barrier by presenting a life policy’s intrinsic value, many insurers focus solely on camouflaging coverage within other offers.

Breaking the Cycle

COVID-19 prompted consumers to purchase protection products in large numbers. Yet those gains fade when the perception of immediate danger subsides, and while consumers reevaluate their wants and needs, the costs of their premiums remain. Once again, insurers appear to be repeating the same cycle of expansion in a crisis followed by decline. The hoped-for “new normal” of sales plateauing at a higher level never seems to arrive, and the insurance gap remains.

Figure 1: YoY Individual Term Life Sales (Jan.-Aug. '2022)

Source: LIMRA, MONTHLY INDIVIDUAL LIFE SALES, January 2022-August 2022

* Less than 1/2 of one percent

This trend can be traced to behavioural biases that favour immediate gratification, but it can also be attributed to a generational shift in priorities. Seventy-two million strong, U.S. millennials represent the largest generation living today, yet surveys show that these consumers, born between the early 1980s and mid-1990s, do not necessarily value the benefits of a long-term insurance investment when weighed against the opportunity to purchase items that offer more immediate gratification. Most Millennials are married or partnered, have children under 18, own homes, and have more than $100,000 in household income. Yet only 45% own life insurance, leaving families at financial risk should a breadwinner die unexpectedly, according to LIMRA’s most recent Insurance Barometer study.

Millennials in this LIMRA survey express greater concern about their financial situations than other generations — 56% say they feel "barely or not at all" financially secure, and eight in 10 say they need life insurance. Yet, puzzlingly, insurers do not see these intentions translate into sustained sales growth; the protection gap in this cohort is frustratingly persistent despite the acknowledged need for insurance. Why?

Reimaging Processes

Innovators, from insurtechs to established carriers, have rushed in to fill this protection gap. Yet, many insurers continue to believe the problem has more to do with the insurance purchasing process than with perceptions of the product itself.

COVID-19 lockdowns led the industry to compress a level of digitization and innovation into two years that might otherwise have taken a decade. Carriers transformed underwriting virtually overnight, launching a wave of accelerated underwriting programs. New apps and technology platforms also emerged that dramatically enhanced the purchasing experience. But while COVID-19 spurred significant improvements in the customer journey from the initial application through claims, insurance products offered in North America hardly changed at all.

Carriers transformed underwriting virtually overnight, launching a wave of accelerated underwriting programs.

In fact, the main life products (term and whole life) have remained essentially the same for two decades, and for good reason. True product innovation requires navigating regulatory complexity and aversion to untested propositions. This can represent a formidable barrier. And yet process change alone is clearly not enough. Now the question is whether, after reinventing processes, insurers can rethink product design and consumer education so that the public begins to prioritize life insurance over other purchases.

Rethinking Product Promotion

The industry needs a new form of innovation: not new products per se, but new messages that meet the current moment. Insurance exists to protect against uncertainty, and today's financial volatility offers a real opportunity. Life insurers and financial professionals can help consumers, including the underserved core demographic of Millennials, reconsider purchasing life insurance coverage not simply because it protects their families in case of some distant calamity, but because it plays an important role in building a holistic strategy for financial security today.

The industry’s best kept secret is its role as an asset in inflationary times.

Admittedly, inflation poses unique challenges to many insurance products. In the past, consumers have purchased annuities as retirement savings vehicles only to see inflation erode annuity values. Also, traditional inflation riders can be unaffordable for many consumers, depending on circumstances, and they tend to offer, at best, 3%-5% inflation coverage. Considering these factors, life insurance becomes even more critical as an instrument of financial protection.

Credited rates for some life products can outpace inflation on their own. Indexed universal life (IUL) products offer a way to take advantage of market returns in a more controlled way; these products can keep up with higher inflation and deliver income. However, purchasing these products does require some excess funding by the insured, so it’s not a solution for everyone.

The real benefit of some life products is that, rather than the cash value portion growing at a fixed interest rate based on the insurance company’s returns, the value is tied to the performance of a market index, like the S&P 500. Unlike investing directly in an index fund, however, policyholders don’t lose money when the market has a downturn, due to a 0% floor on the credited rate. Thus, if the market is down 10%, the interest credited to the account is 0%, not -10% as it would be with a variable universal life insurance policy.

IUL limits both sides of the interest credited through use of a cap that the company will occasionally reset. Variable universal life would allow for more returns, but the insured must ride the highs and lows rather than the guardrails of IUL. Careful use of IUL distributions can supplement income through withdrawals and loans against the cash value; there is no minimum age for distribution, and policyholders can borrow from the policy without necessarily paying back the loans.

Insurance can and should be viewed as a supplement to a 401(k), Roth IRA, or other retirement or savings vehicle. And with inflation rising faster than interest rates, anyone sitting at the sidelines is losing money every day. Carriers have a unique opportunity to communicate all the ways insurance can be a very affordable and accessible asset that can make a family more financially secure.