Like much of the rest of the world, China faces the many challenges of an aging population.

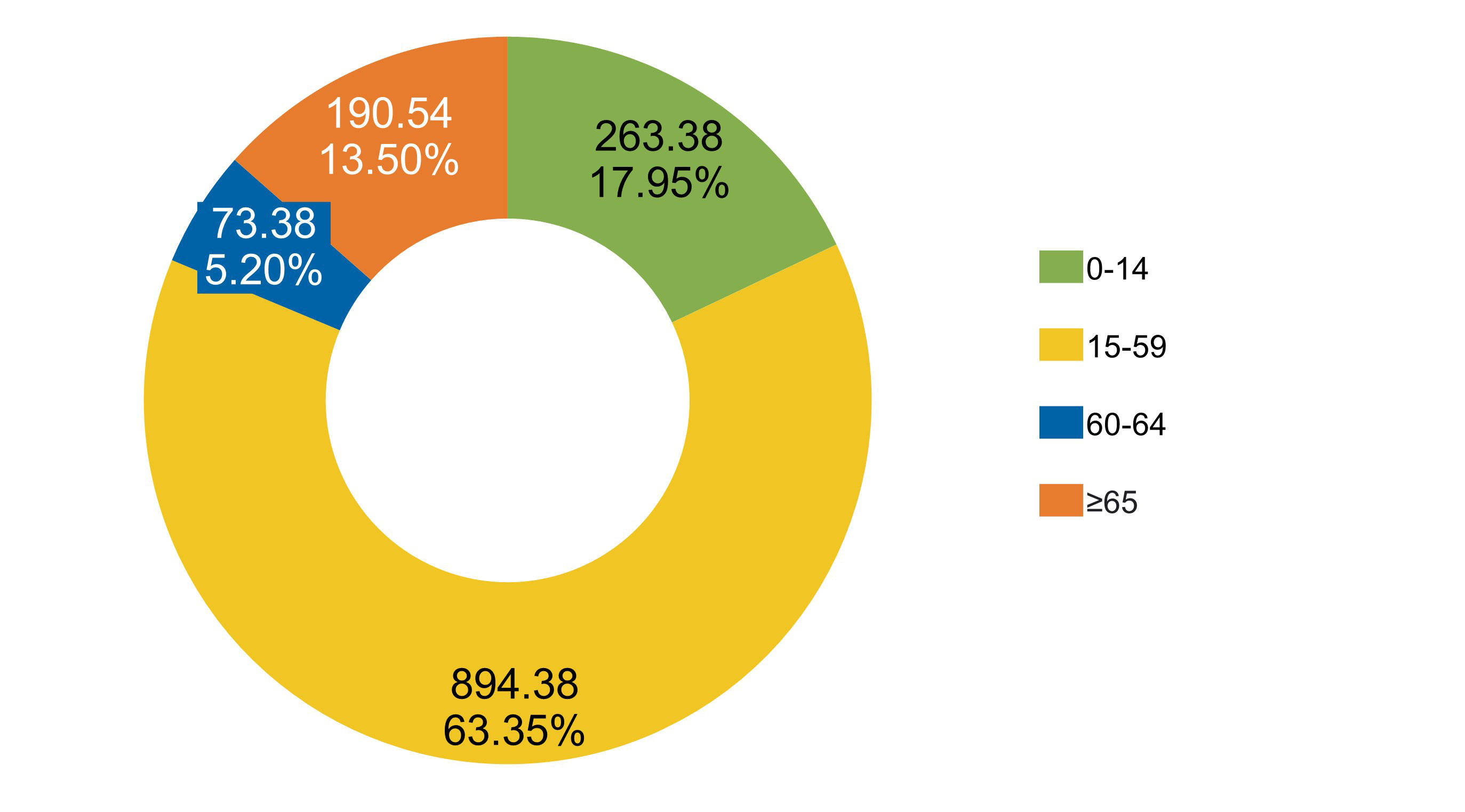

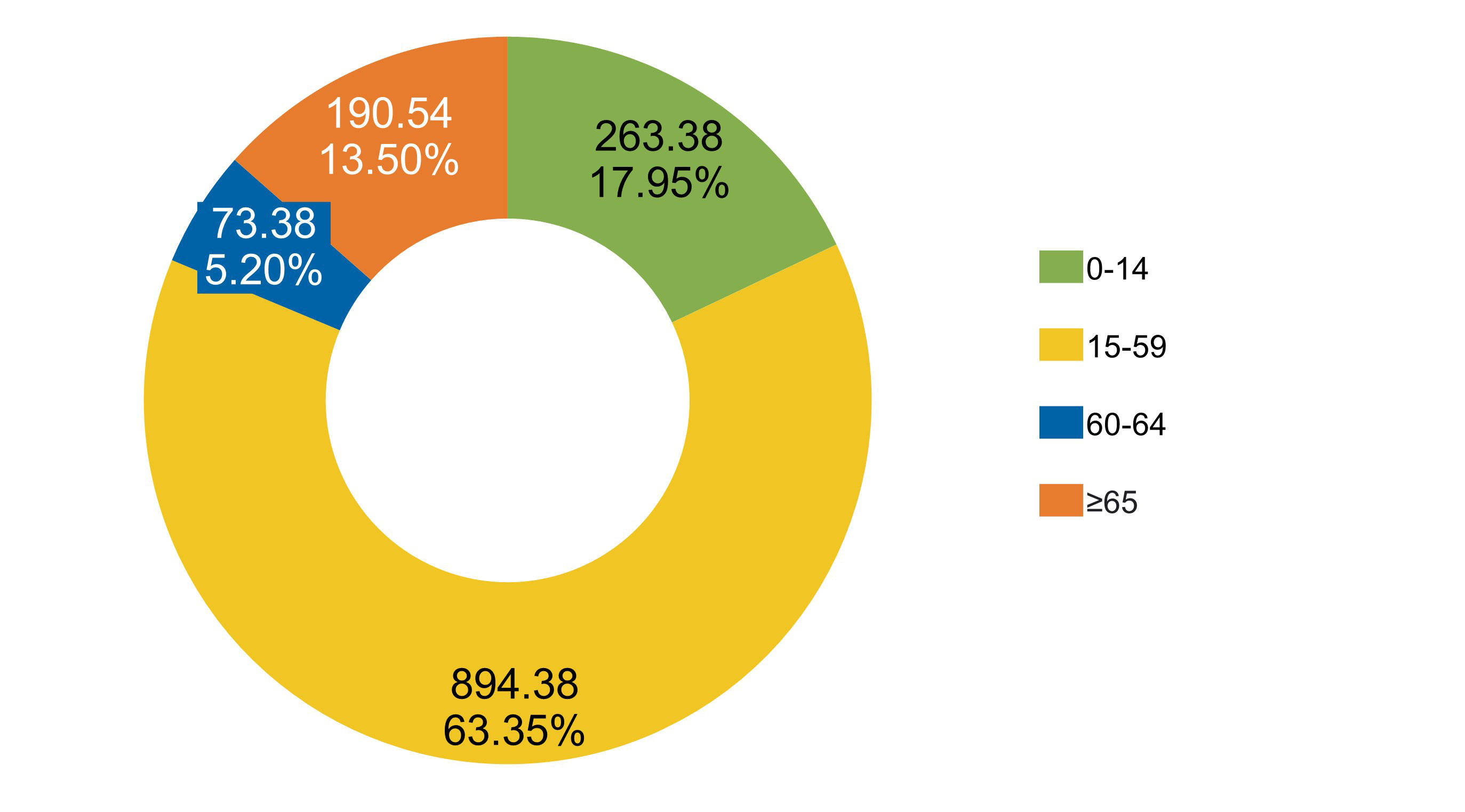

According to the Seventh National Census, the number of people over 60 in China reached 264 million in 2020, comprising 18.7% of the total population. Of these, 191 million, or 13.5%, were over 65. By 2025, China's elderly population is expected to exceed 300 million, bringing profound challenges to its society and economy, as well as its insurance industry.

The life insurance market in China is undergoing a transformation, and the resulting pressures have produced a range of business challenges:

- receding growth in total premiums

- declining number of agents

- persisting channel development bottlenecks

- mounting obstacles to growth in new premiums and new business values

The market is transitioning from rapid expansion to more high-quality business development as a greater number of life insurance products return to the primary function of risk protection. Amid the resulting strategic opportunities and risk assessment challenges, insurers are seeking answers to important questions: What will be the next turning point for the industry? What will be the next market breakthrough? What will be the next hot product with a high-quality supply?

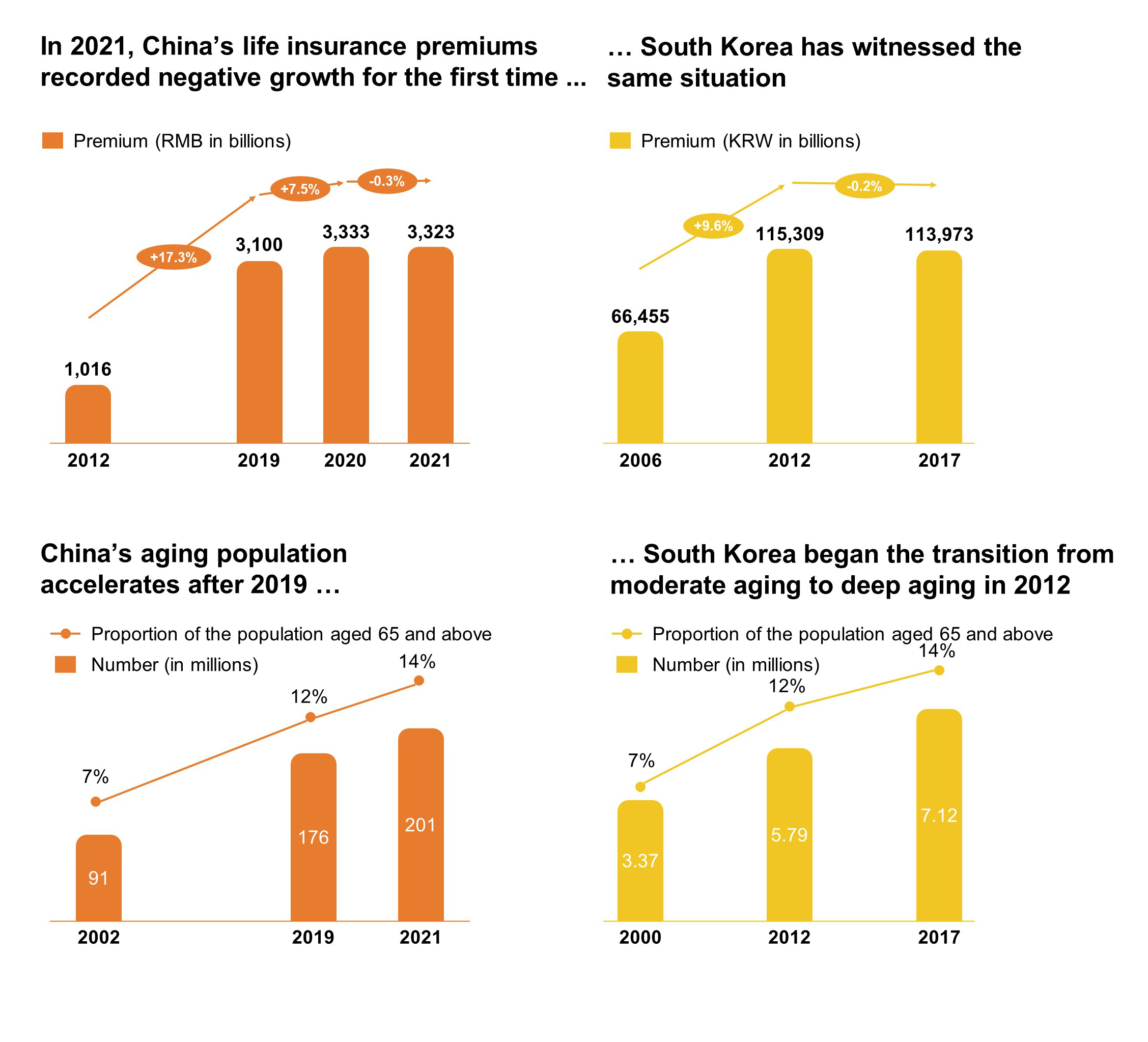

A model to follow: Transformation lessons from South Korea

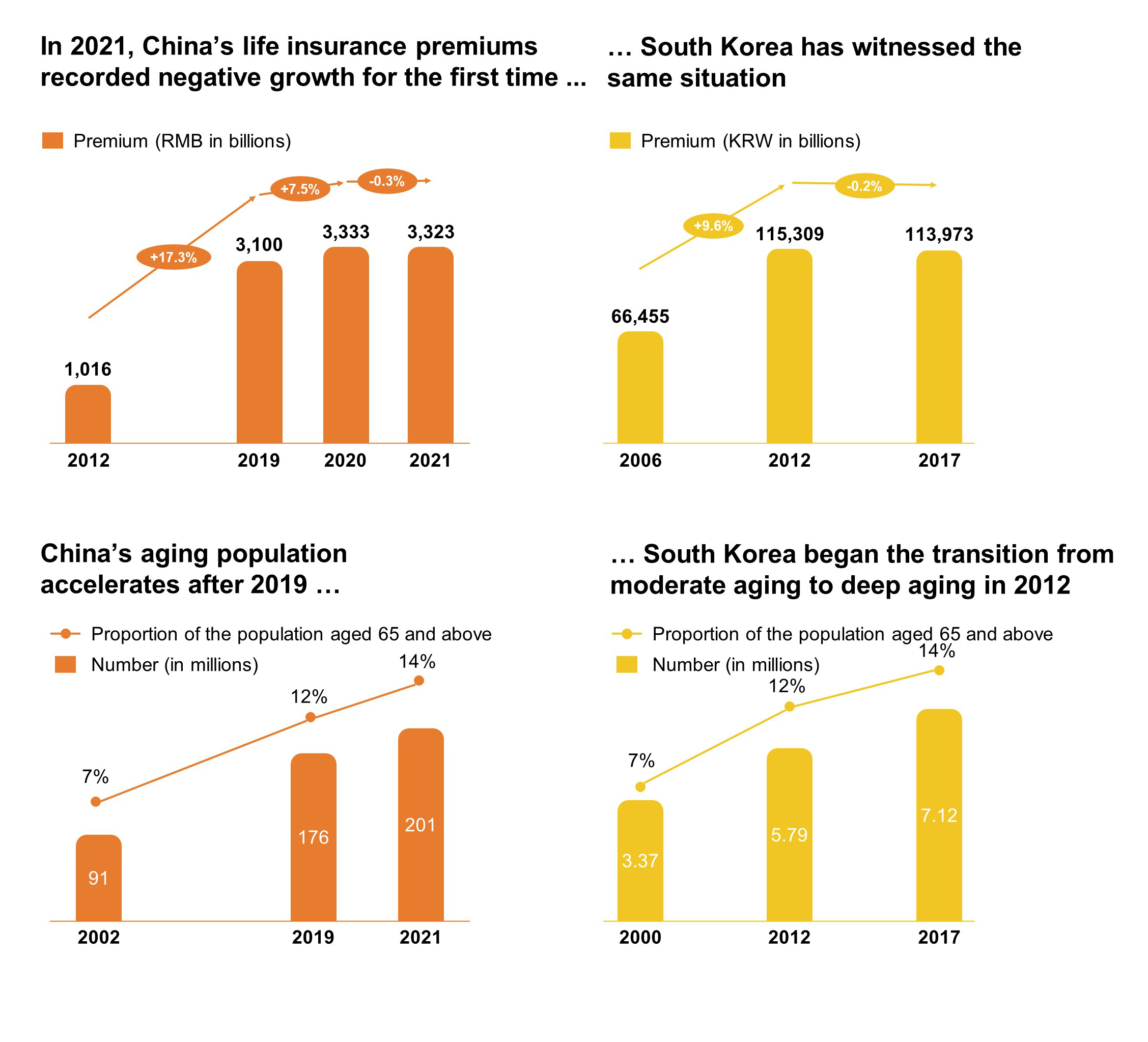

The South Korean life insurance market faced China's current predicament starting around 10 years ago. In 2021, China’s life insurance premiums declined for the first time. In South Korea, life insurance underwent a long stagnation period following a business peak in 2012. In China, the number of insurance agents has shrunk by 30-40% in the past two years. In South Korea, the number of agents peaked in 2012 and declined by 30% five years later.

Underlying these developments is a general shift within insurance’s main demographic group: people ages 45-60. The proportion of impaired lives in this age group in China is up to 50% or even higher, limiting insurance sales to this group for traditional products with standard underwriting requirements and leading to the subsequent loss of agents and the reduction of agent team size. Eventually, these conditions give rise to bottlenecks that slow market development.

Source: Korea Life Insurance Association

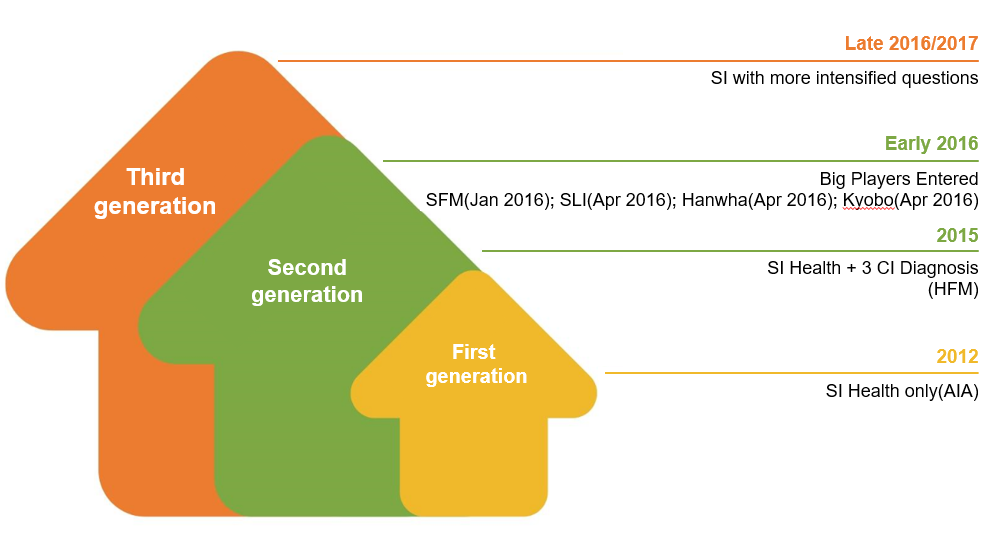

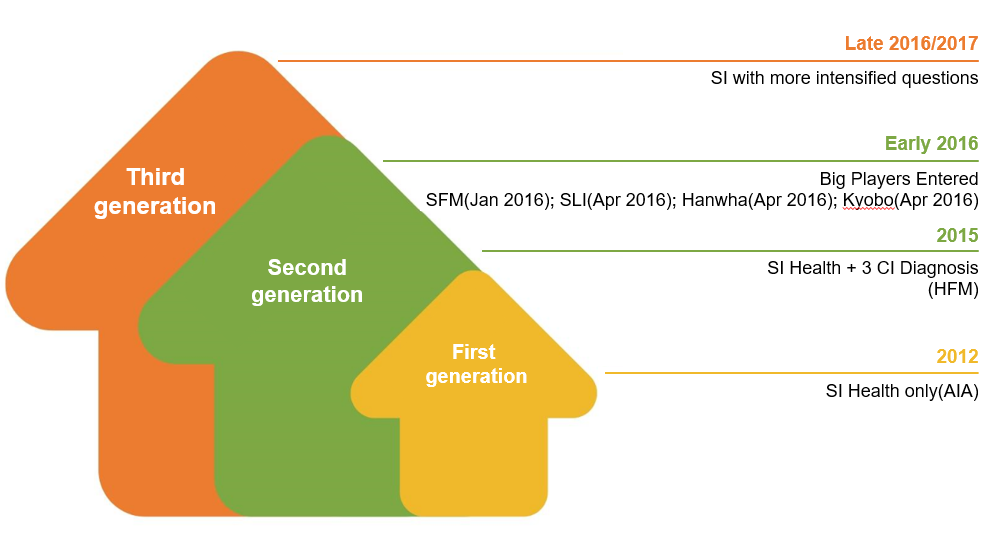

Life insurers in South Korea made a rather bold and avant-garde attempt to break through this adversity. With a surging demand for protection of impaired lives, insurers attempted to reach and serve more people by leveraging simplified issue (SI) products, which provided a new source of effective and economically feasible insurance coverage. Since the launch of the first generation of SI products in 2012, the market enjoyed an SI business boom in 2016 and has witnessed several years of experience accumulation and product iteration. SI offerings have evolved quickly in Korea over that time, becoming the gold standard in providing protection for impaired lives and enabling the Korean life insurance market to overcome what had been significant obstacle to business growth.

Development Stage of SI product in South Korea

Blue ocean market in China: Urgent protection needs, lack of product supply

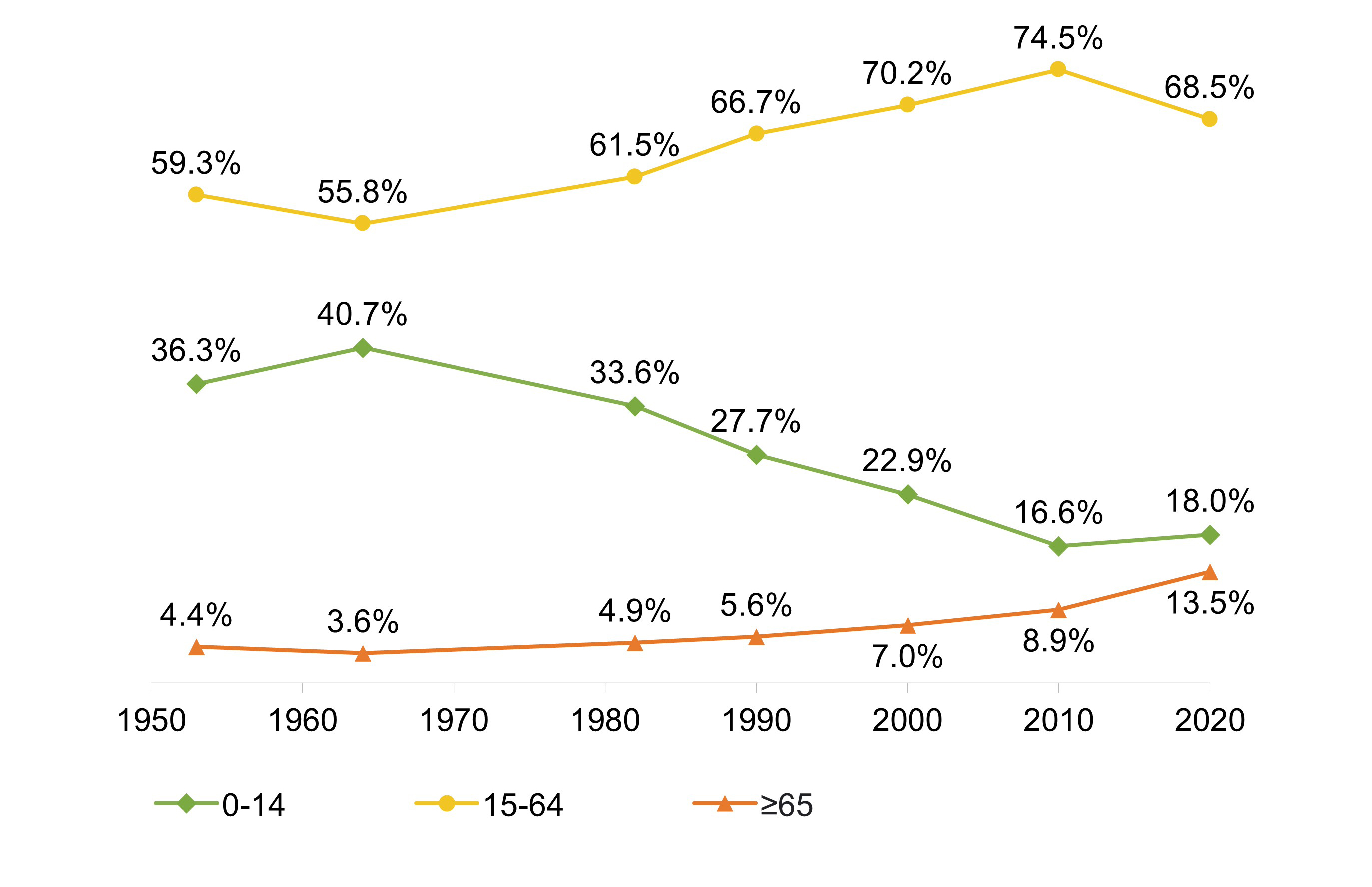

Like Korea a decade earlier, China is now experiencing increased demand to insure impaired lives. China's population is still relatively young compared to other developed countries in Asia, but it is aging rapidly. According to The Seventh National Census, compared with 2010, the proportion of people ages 0-14, 15-59, and over 60 increased by 1.35%, decreased 6.79%, and rose 5.44%, respectively.

Population by age and proportion of total population in 2020 (in millions)

Source: The Seventh National Census

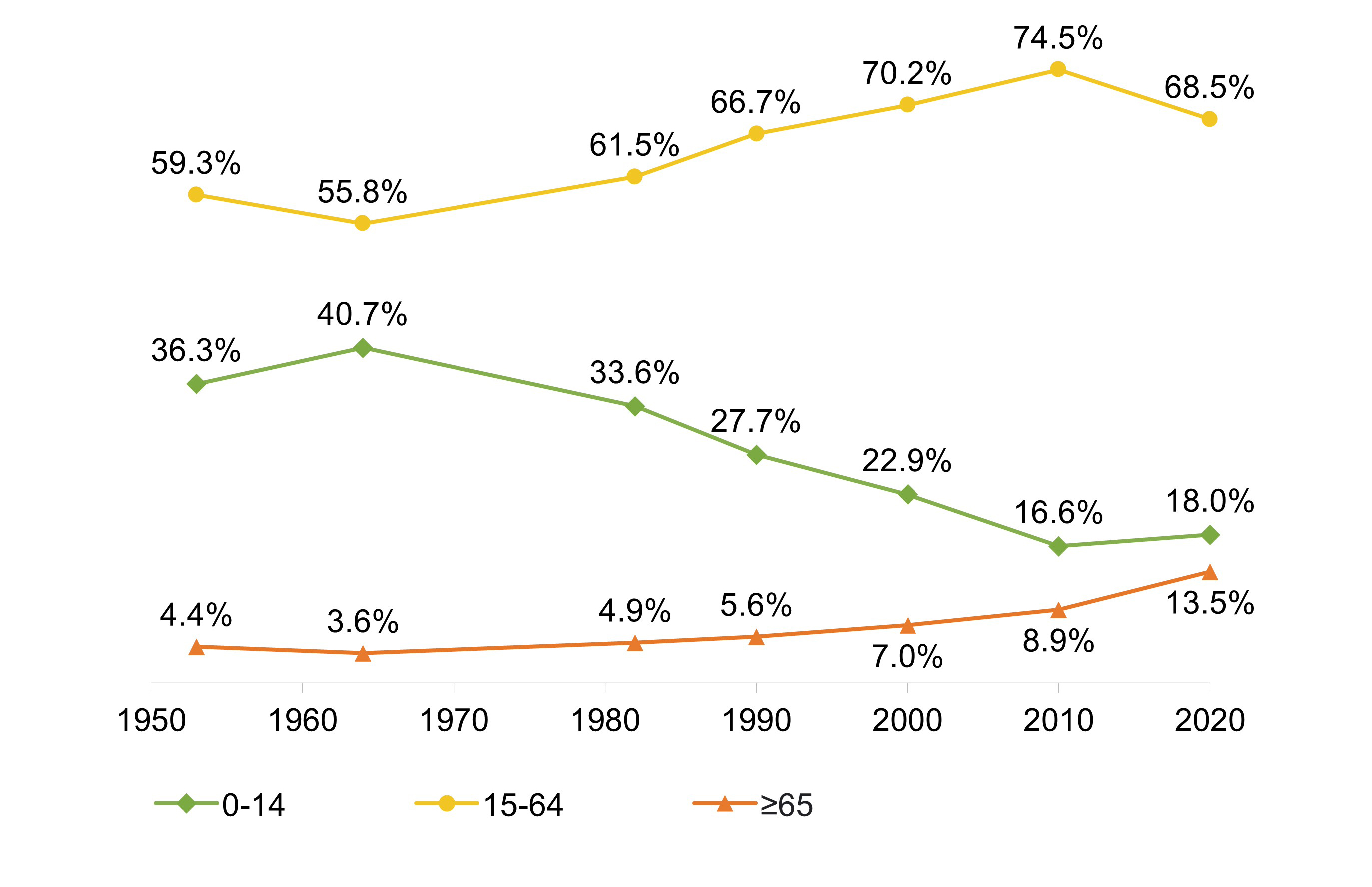

The proportion of different age groups in the total population over the years (%)

Source: The Seventh National Census

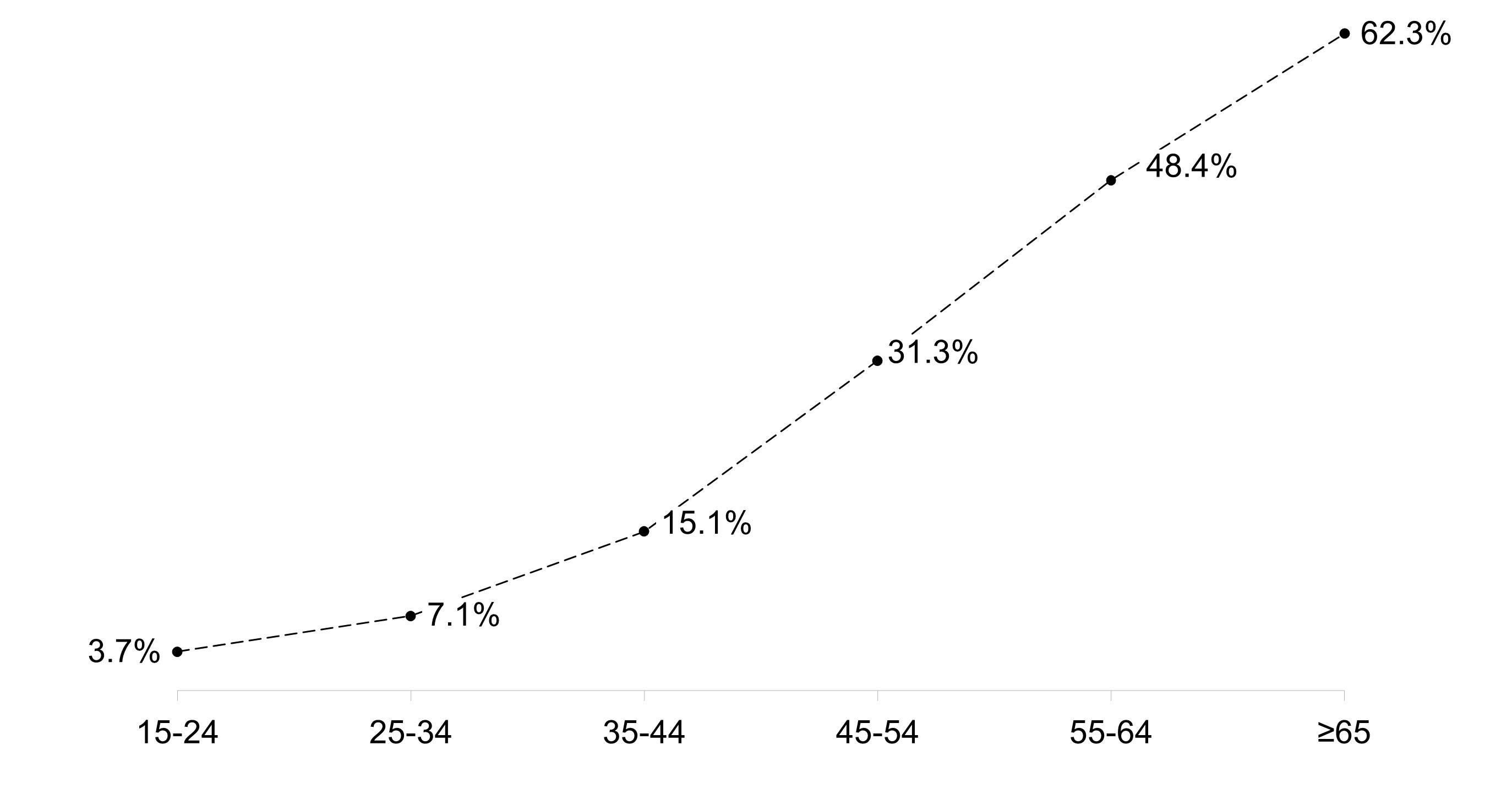

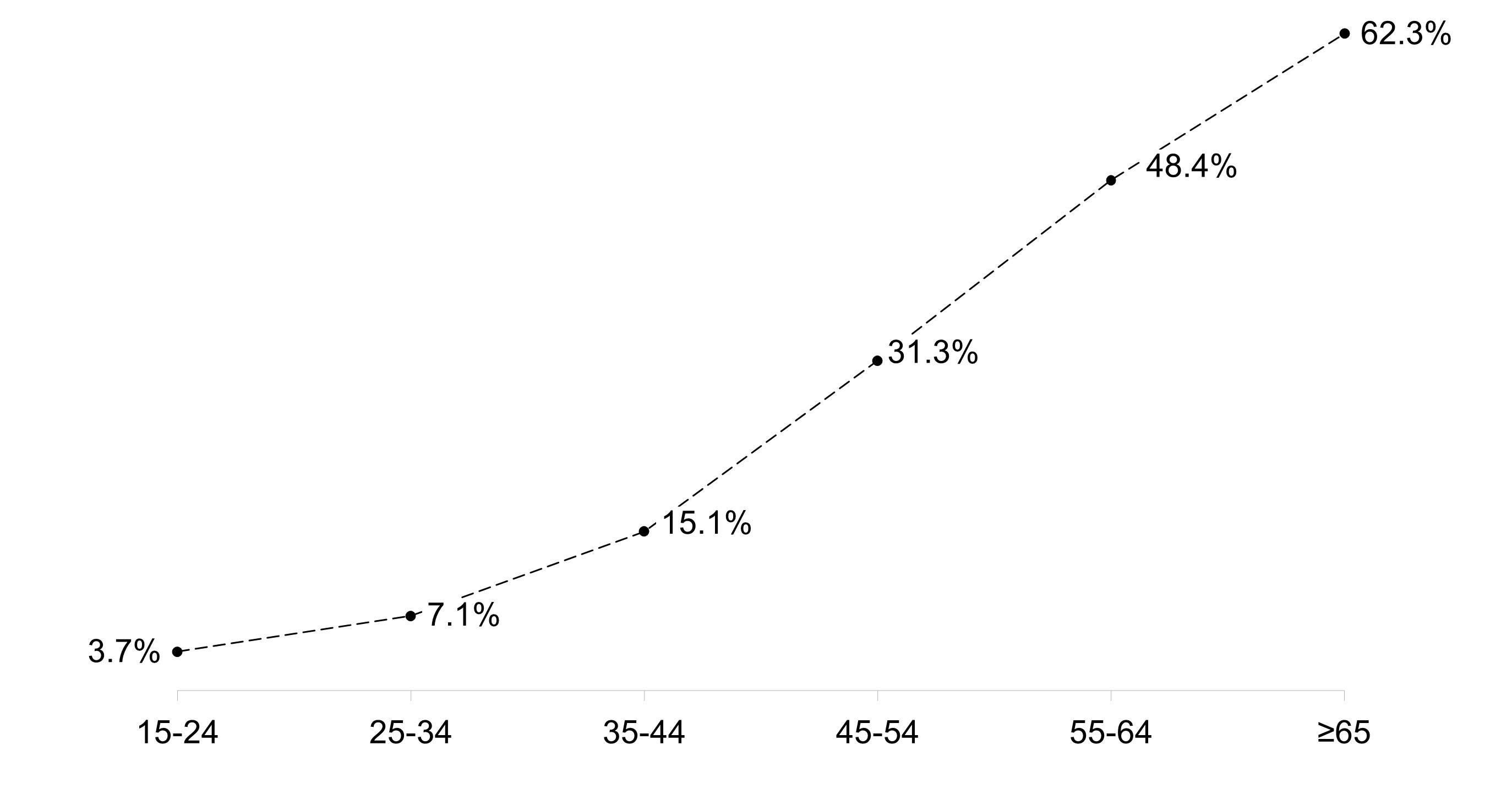

As the population ages, the number of impaired lives increases. According to the Report on the Status of Nutrition and Chronic Diseases of Chinese Residents (2020), the prevalence of hypertension, diabetes, and other chronic diseases among Chinese residents has increased significantly compared with 2015. The Expert Report on the Sixth National Statistical Survey of Health Services found that the number of chronic diseases in China exceeded 400 million in 2018. The prevalence of chronic diseases among people ages 55–64 is estimated to have reached as high as 48%, while the incidence in people over 65 is as high as 62%. However, the proportion of these impaired lives who can obtain insurance coverage remains very low, creating a significant coverage gap. According to a McKinsey report, health insurance premiums for impaired lives in China in 2020 totaled approximately RMB$5 billion, accounting for only about 5% of the nation’s health insurance premiums.

Age-specific prevalence of chronic diseases aged 15 years and above (%)

Source: Expert Report on the Sixth National Statistical Survey of Health Services

Traditional insurance mainly covers healthy people while products for impaired lives are generally limited to short-term medical or cancer coverage. Applicants can face obscure underwriting questionnaires and lengthy and complex underwriting processes when applying for long-term protection, only to find later that an exclusion applies or that an additional fee is required. SI usually features only three core questions that can be answered simply for quick review and approval, greatly reducing the time and effort required and increasing customers’ ability to obtain coverage.

Powered by this simplicity and directness in application and underwriting processes, SI products have proven to be an ideal solution to help narrow the protection gap for impaired lives. The use of only three transparent and easy-to-understand questions facilitates distribution through a range of channels. It also enables more targeted marketing to potential customers and increases approval rates, thereby improving conversions on both ends of the sales funnel. By removing multiple obstacles to underwriting impaired lives, SI offers life insurers an opportunity to enter this blue ocean market in China, which has the potential to break through a fiercely competitive landscape and provide new paths to incremental growth.

Simplified issue: A proven solution for impaired lives

The initial intention of SI product design is not based on technology, but on market needs, customer preferences, and channel capabilities. The structure and content of the three core questions in the health declaration questionnaire of today’s SI products are the result of many years of accumulated knowledge, hands-on experience, and learning from successes and failures in markets such as Korea. Behind this outwardly simple questionnaire are carefully calculated adjustments to risk screening criteria and underwriting rules – a revolutionary step forward from the traditional insurance concept.

The theoretical basis of life insurance is the law of large numbers, which poses that the uncertainty (risk) of individual cases will tend to balance out among large numbers. This enables insurers to assess the relative risk of any single individual and reasonably determine a premium rate that, when paid by all policyholders, will balance the insurer’s overall loss compensation and expenses within the insurance term. For the law of large numbers to work, the insureds must share similar risk profiles, which requires complex underwriting questionnaires and underwriting rules to accurately identify healthy applicants for approval. However, in the world of SI, the three seemingly simple questions are essentially subversive adjustments to the risk screening mechanism, changing the traditional insurance concept of using precise underwriting methods to select healthy applicants to using more general underwriting questionnaires to identify impaired lives.

Compared with SI, the multi-level questionnaire currently used for chronic disease medical reimbursement and critical illness products in China is much more complicated. The applicant must work through layers of difficult medical-related queries to be insured. Moreover, the judgment criteria for determining insurability are far from transparent. From the applicant’s perspective, the underwriting rules are a black box behind which complex logic is used to achieve customer risk stratification.

SI transforms this process. Through the three core questions, SI selects those applicants with impairments who are determined to have controllable risks. Only the most impaired cases with uncontrollable risks are excluded. It thereby condenses the sales process while following appropriate underwriting standards and solves the problem of providing coverage to people with medical conditions, who are often not covered by traditional insurance.

Compared with the so-called “simplified” questionnaire of cancer products in the market, SI asks not only fewer questions, but more streamlined questions. Rather than inquiring about vague and easy-to-misunderstand symptoms, SI clearly and objectively asks about disease history and medical activity such as examinations, hospitalization, and surgery. In addition, a larger and more obvious difference with cancer products is that SI products cover a much wider range of impairments.

The outward simplicity of SI is made possible by meticulous preparation in designing and pricing the products. Changes in the risk screening mechanism, i.e., underwriting rules, vs. traditional underwriting significantly increase individual variations among insureds. Additionally, customer behavior and distribution channel activity are more difficult to quantify and predict with SI. As a result, a range of additional risk control factors must be incorporated into product design.

Meanwhile, product pricing becomes more difficult and experience fluctuations more frequent. As a result, the development and success of SI products depends on close cooperation between direct insurers and reinsurers. Reinsurers can provide professional advice on the underwriting questionnaire and product design, as well as offer data and experience support for product pricing. More importantly, financial backing through reinsurance delivers a final, vital risk control.

RGA has helped lead the emergence and expansion of the SI market in South Korea, partnering with insurer clients to develop innovative risk screening mechanisms in place of full underwriting across a spectrum of distribution channels and through multiple generations of products. In 2022, RGA partnered with a leading insurer in China to launch that market’s first SI critical illness (CI) product. Teams from RGA and the insurer worked together closely for four months to transplant this originally Korean concept, adapting the underwriting approach and product design specifically to the Chinese market. The result is a truly innovative product that retains the essential risk protection of traditional CI products while bringing greater access to insurance protection and financial security for people living with chronic diseases.